Societe Generale notes:

Gasoline prices reversed sharply in May, having risen by a little more than 10% mom. Given a very small seasonal adjustment in May, we expect the SA index to show a 9.8% increase. Food prices in the PPI posted the first sequential increase since November and the largest gain since April 2014.

We expect a similar outcome in the core CPI expected to post a trend-like 0.2% increase, the aforementioned pressures on the food and energy front are expected to propel the headline CPI index 0.6% higher. Within the core price index, we expect some moderation from the 0.3% increase posted in April and look for the subindex to rise by 0.17% m/m.

Shelter inflation continues to be supported by the recent increase in household formations and by the related drop in the rental vacancy rate. Public transporation costs likely accelerated on the back on higher energy prices, offsetting the moderation in medical costs after the April surge.

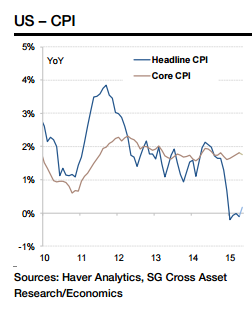

If our assumptions materialize, the yoy headline inflation will rise from -0.2% to 0% and core inflation will remain at 1.8% in May. We believe that headline inflation has bottomed and will rise sharply over the remainer of the year.

We project headline CPI at 1.7% by December and 2.5% by March 2016, with core inflation at 2.3% and 2.5% for the respective periods.

US - A gasoline price surge to lift CPI

Monday, June 15, 2015 12:19 AM UTC

Editor's Picks

- Market Data

Most Popular

5

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX