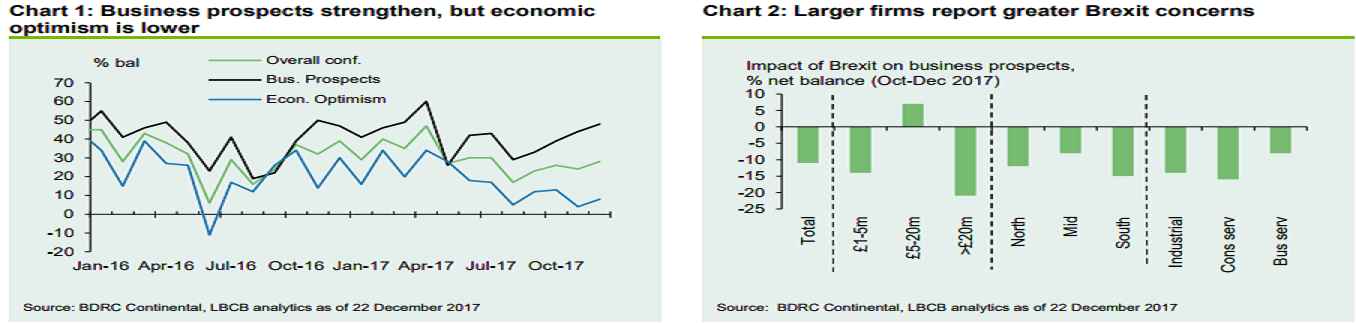

The United Kingdom’s stronger business prospects have belied any prospects of a wider economic growth, according to a recent survey report from Lloyds Bank. In general, firms anticipate their own business prospects to remain resilient over the coming year but remain concerned about the outlook for the economy.

The notable exception is firms with larger annual turnover (above GBP20 million), which reported weakest business prospects and also the biggest concern about the impact of Brexit (the UK’s decision to leave the EU) in the last three months.

Overall business confidence rose by 4 points in December to a 5-month high of 28 percent. The increase this month reflected rises in both business prospects and economic optimism. The net balance of firms expecting stronger business prospects increased for a fourth consecutive month, by 4 points to 48 percent, the highest level since April and above the long-term average of 44 percent.

The net balance reporting greater optimism regarding the economy also rose by 4 points, but at 8 percent it remains at a somewhat weaker level than business prospects and is well below the long-term average of 19 percent. In terms of hiring intentions, there are signs that they have softened in recent months. The net balance of firms expecting to add to their headcount over the coming year remained positive but fell by 5 points to 23 percent, the weakest level since May.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances