UK government bond yields appear to be stuck around an inflexion point - undecided whether to fall in response to emerging market concerns, or rise due to still solid domestic demand growth and emerging capacity constraints. Add to this, the uncertainty surrounding the outlook for US and euro area monetary policy and bond yields, and little wonder that market participants appear to lack conviction. Having fallen sharply over the summer, 10-yr gilt yields have traded in a narrow range in recent weeks, ending the past month little changed at 1.85%.

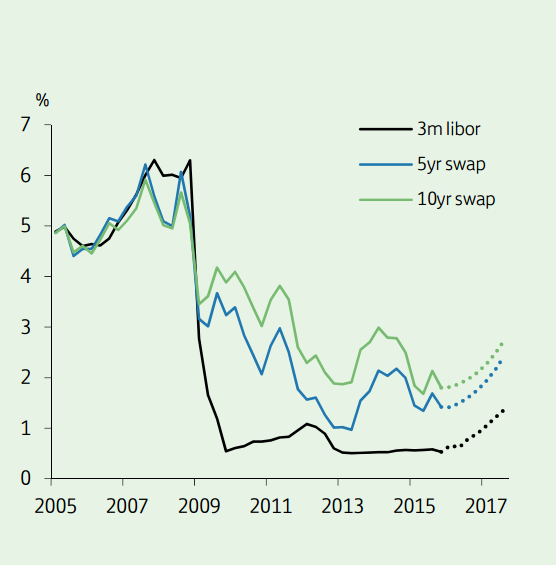

The policy rate outlook is similarly clouded. Just four months ago the market had expected that UK Bank Rate would be increased by next spring. That expectation has since been pushed out to early 2017. Concerns that China/emerging Asia may precipitate a downturn in world growth have led to a reassessment of the global policy outlook. At home, these concerns have coincided with some softening in business surveys and a drop in inflation to -0.1% y/y in September.

Still, the recent shift in UK rate sentiment is significantly overdone. Unless the downturn in China is especially severe, the impact on the UK is likely to be limited - not least as China accounts for only 3.5% of the UK's exports. Indeed, as an oil importer, the UK should continue to benefit from associated weakness of oil/commodity prices. More broadly, the UK is in the midst of a reasonably solid late-cycle expansion.

Notwithstanding the international climate, the unemployment rate has recently dropped to a 7-year low (of 5.4%), wage growth is picking up (to around 3.0%), while recent downward revisions to productivity suggest supply-side impediments persist. In short, on capacity grounds, there is a reasonable case for nudging interest rates higher. There is also a case on financial stability grounds, given the degree of leverage and the associated volatility of asset prices.

"We are not yet minded to change our call that UK interest rates will start to rise by spring next year", says Lloyds Bank.

Over the coming month, we will be watching the domestic and international data especially closely, with the Bank of England Inflation Report on 5 November and the all-important US labour statistics the next day. The latter is likely to be instrumental in determining whether the US Fed will raise rates by the end of the year and, by extension, whether the BoE will follow shortly thereafter. If the Fed begins its tightening cycle, bond yields across the sterling curve are likely to follow US term rates higher.

UK rates review

Thursday, October 22, 2015 12:45 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022