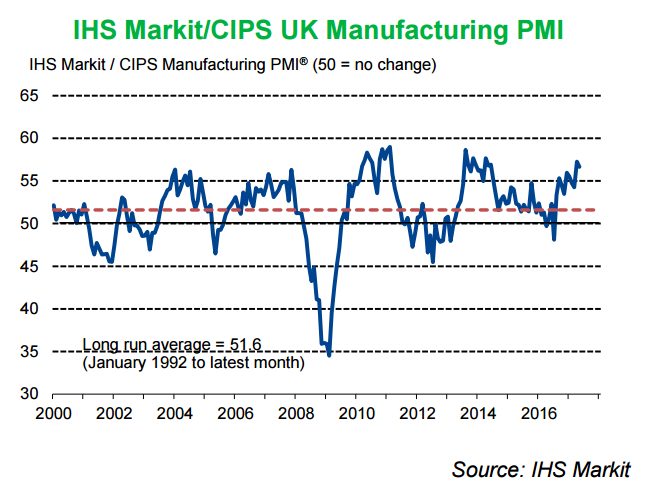

The seasonally adjusted IHS Markit/CIPS Purchasing Managers’ Index for May released on Thursday showed that UK’s manufacturing sector remained resilient in May. UK May manufacturing PMI dipped only slightly to 56.7 from 57.3 in the previous month, broadly in line with expectations. A modest dip was expected after the outsized gain in April. The ongoing strength of the domestic market proved to be the main driver of the upturn.

Details of the report showed solid expansions of production and new orders across the consumer, intermediate and investment goods categories. The continued strength of the domestic market lent solid support. There was also a solid increase in new export business as well. Rates of inflation in input costs and output charges remained elevated in May, despite easing further from recent highs. Despite easing to a five-month low, the increase in selling prices was still among the fastest seen in the survey history.

Optimism regarding the outlook for production levels in one year’s time improved to a 20-month high, with 56 percent of manufacturers forecasting output to rise during the next 12 months. The positive steer for output expectations was reinforced by a further increase in outstanding orders, which rose to a six-year high. The rate of jobs growth increased for a fourth-consecutive month.

"The elevated level of the PMI suggests that the contribution of manufacturing to UK GDP growth in 2017 is likely to be more positive than in recent months. That view is supported by the newly introduced future expectations balance, which at 75.0 is at a 20-month high, well above the 50 no-change mark," said Lloyds Bank in a report.

Nevertheless, manufacturing sector accounts for only around 10 percent of UK economic activity. Focus will remain on the dominant services sector and next Monday’s service PMI data will reveal a better picture of the overall outlook for UK economic activity. A downside surprise cannot be ruled out in the wake of a new poll that suggests that Prime Minister Theresa May’s Conservative Party could lose its majority in Parliament – a prospect that would further heighten uncertainty about the path ahead for Brexit negotiations.

Pound slipped as UK manufacturing activity fell in May. GBP/USD was down 0.3 percent and was trading at 1.2853 at around 1115 GMT. At the same time FxWirePro's Hourly GBP Spot Index was bullish at 99.0407 levels. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal