There were only minor changes in the underlying forces driving CPI inflation in October. Food inflation looked pretty stable, as evinced by the BRC shop price data, and auto fuel prices have fallen by less than last month and in the same month last year. The interest focuses mainly on core CPI drivers.

As Kristin Forbes of the BoE MPC has emphasised repeatedly, the goods price component has been driven down by the past appreciation of the pound. The big question is whether that effect has now peaked. Forbes seems to believe it has done so. Core goods inflation reached a nadir of -1.5% yoy in June and has since moved between -0.7% and -1.2% yoy.

"We take this as tentative evidence in support of Forbes' view and indeed that is our own view as well. We expect a modest upward move to -1.0% yoy in October from -1.2%", notes Societe Generale.

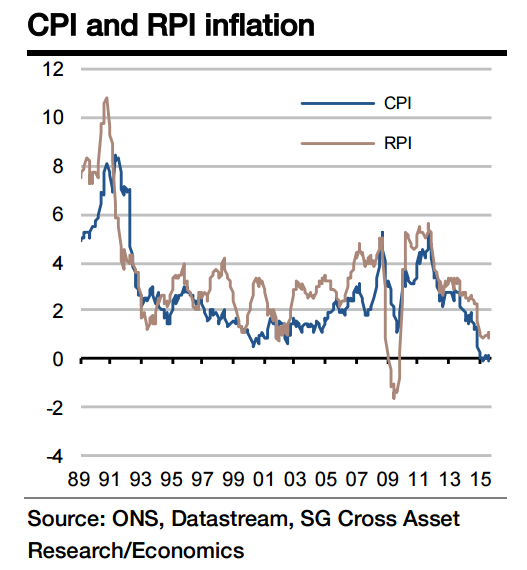

Services inflation should at least match the September reading of 2.5% yoy and might exceed it. This should result in core inflation rising from 1.0% to 1.1% yoy. Overall, this suggests that inflation should rise from -0.1% to 0.0% yoy. RPI inflation should rise from 0.8% to 1.0% yoy.

UK inflation to rise to precisely zero

Monday, November 16, 2015 10:58 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed