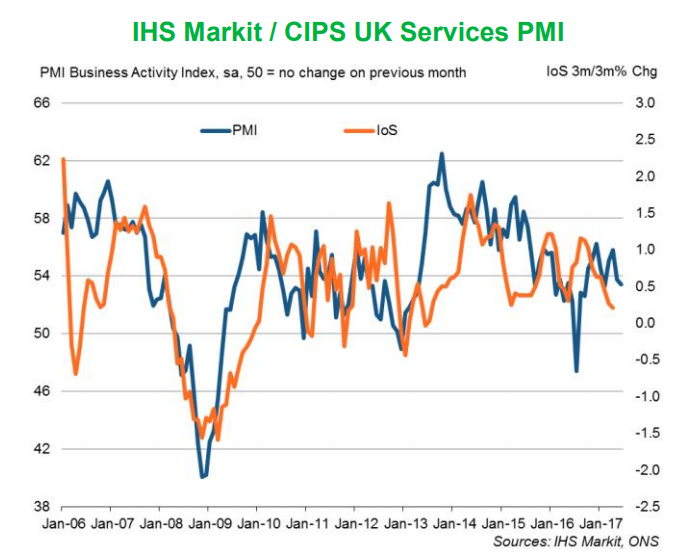

UK service sector growth slowed in June and business optimism hits lowest level since Brexit vote, survey data released earlier today by Markit/CIPS showed. Markit/CIPS UK Services Purchasing Managers' Index (PMI) fell to a 4-month low of 53.4 in June from 53.8 in May, missing forecast for 53.5 in a Reuters poll of economists. Data is likely to be a disappointment for hawks on the Bank of England (BoE) Monetary Policy Committee (MPC) who want to raise interest rates.

Today's data followed on from weaker manufacturing and construction surveys, completing a triple-whammy of disappointing PMI survey readings. The softer services PMI points to an already fragile economy struggling on account of uncertainties about the economic outlook and intensification of political uncertainty following the general election and commencement of Brexit negotiations.

Britain's economy barely grew in the first three months of the year dented by accelerating inflation, uncertainties caused in large part by the Brexit vote and slowing wage growth. Despite the slowdown, the three PMI surveys are running at levels that are historically consistent with GDP growing by around 0.4 percent in the second quarter.

Sharp and accelerated increase in average cost burdens at service sector companies. The overall rate of input price inflation was nonetheless still much slower than the peak seen in February. Service sector firms are optimistic overall that business activity will rise over the next 12 months. However, the degree of confidence fell markedly since May.

"Given the deterioration in the forward-looking indicators, such as business optimism and order book growth, the risks are tilted towards the economy slowing in the third quarter," said Chris Williamson, Chief Business Economist at IHS Markit.

Pound skids to one-week low as UK service sector growth slows in June, while the FTSE 100 turned negative in mid-morning trade after the latest PMI disappointment. The index recovered from lows and was trading at 7370 points up 13.52 points at 1135 GMT. Cable largely muted, trades a narrow range on the day. Daily cloud offers strong support at 1.2911, break below could see further drag.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out