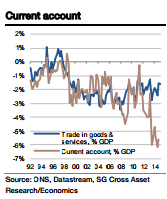

The UK trade account is relatively stable but the current account deficit has exploded in recent years because of a collapse in net property income. The latter has come about as a result of the UK's economic outperformance relative to the rest of Europe which has attracted more FDI.

This is not likely to change quickly and so the current account deficit is expected to remain very wide.

In the short term, the net property income component is assumed constant, so the forecast is based on changes in the trade account.

"The trade deficit for Q1 is already known, it widened from an originally to £7262mn which should push up the current account deficit from £25.3bn to £26.6bn. The Q4 trade data have subsequently been revised to £6916mn which should lead to a similar revision to the Q4 current account", says Societe Generale.

UK current account deficit to widen slightly

Monday, June 29, 2015 5:39 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed