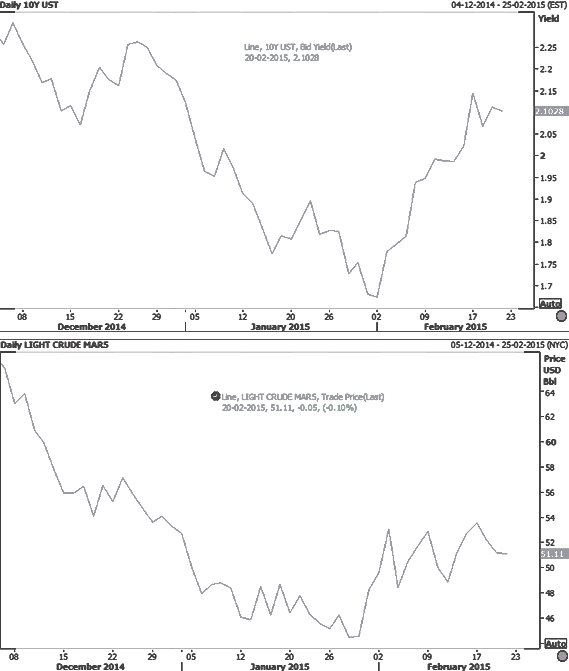

Recent data shows that long end of treasury yields are reacting well to the rise and fall of oil prices. Chart is included in support of such.

If the trend continues various scenarios could be -

- If crude prices fall further, this could affect the long term inflation expectation thus resulting in flattening of the yield curve. This scenario has higher probability in the near term.

- If crude oil price though currently depressed starts recovering fast there could be a surge in global inflation and severe drop in bond prices across globe.

Though the second scenario looks a bit far reaching but is expected to be of greater concern & consequence than the former. It also looks like the future, even if a little distant. It could be the inflection point to adjust portfolio of stocks, with commodities & gold.

WTI crude currently trading at 49.28 down more than 3% for the day, 10 year treasury yield is around 2.07% down 2 basis points from yesterday.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary