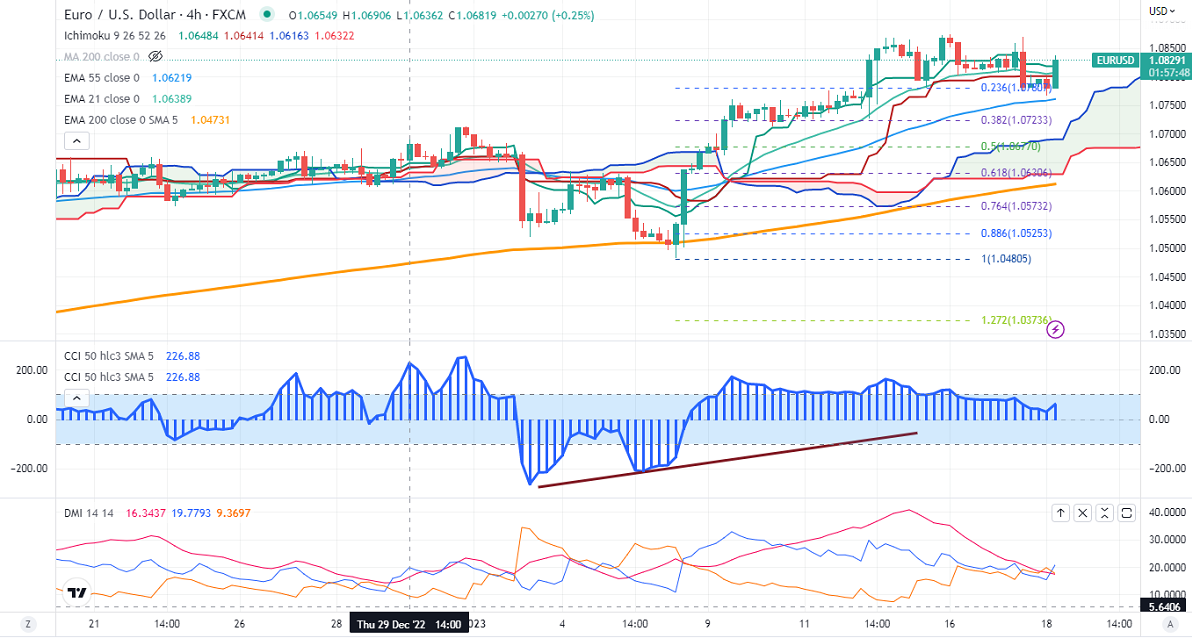

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.08179

Kijun-Sen- 1.08005

EURUSD regained above 1.08000 after a minor decline to 1.07663 on board-based US dollar weakness. Hawkish ECB and upbeat Euro economic data support Euro at lower levels. German ZEW economic sentiment improved to 16.9 in Jan vs the -15.50 expected. Markets eye US retail sales and PPI for further direction. It hits an intraday high of 1.08339 and is currently trading around 1.08265.

Technical:

The pair is trading above short-term (21 and 55 EMA) and long-term (200-EMA) in the 4-hour chart. Any break above 1.08750 confirms minor bullishness, with a jump till 1.0925/1.09500/1.100 likely. The near-term support is around 1.07600. The breach below will drag the pair down to 1.0700/1.0660/1.0600.

Indicator (4-hour chart)

CCI – Bullish

Directional movement index – Neutral

It is good to buy on dips around 1.0800 SL around 1.0760 for the TP of 1.100.