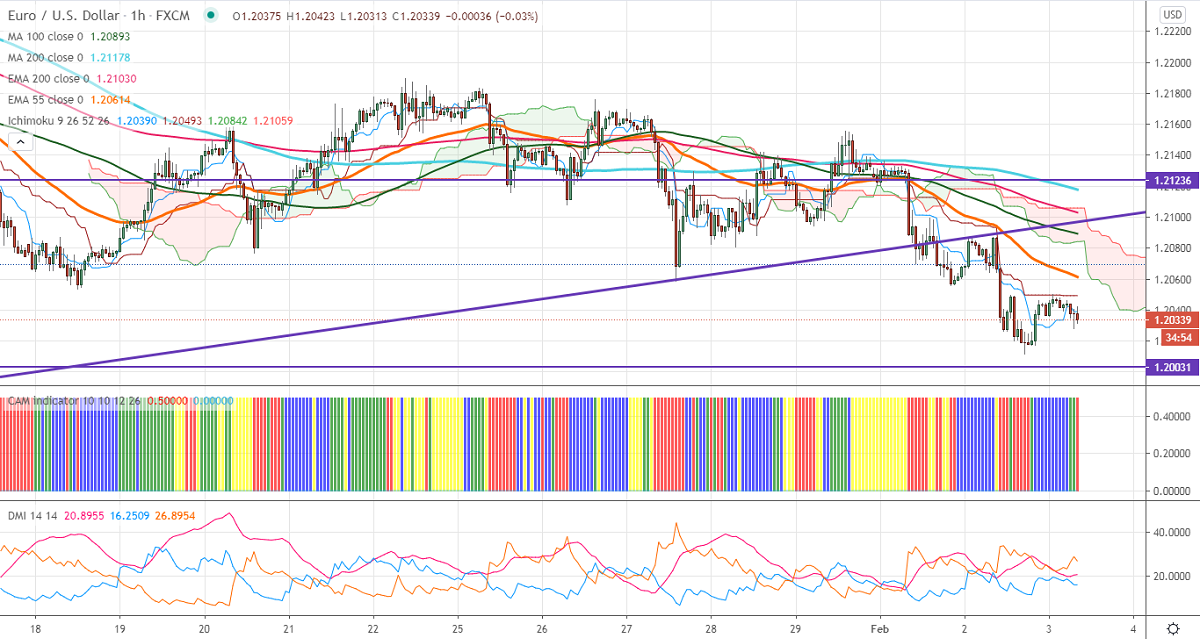

Ichimoku analysis (1-hour chart)

Tenken-Sen- 1.20390

Kijun-Sen- 1.20493

EURUSD lost more than 150 pips from a high of 1.21896 made on Jan 22nd, 2021. The surge in coronavirus cases and lockdown restrictions in some countries has increased demand for safe-haven assets like the dollar. Markets eye Eurozone CPI and US ADP employment, ISM services data for further direction has increased demand for safe-haven like the US dollar. The spread between US 10-year yield and German bund narrowed to 158 basis point from 171 basis point. The pair hits an intraday low of 1.20278 and is currently trading around 1.20398.

Technical:

On the higher side, near-term resistance at 1.20620. Any indicative violation above targets 1.21150/1.2150. The next support is around 1.2000. Breach below will drag the pair down till 1.19550/1.1900.

It is good to sell on rallies around 1.2049-50 with SL around 1.2090 for the TP of 1.1955.