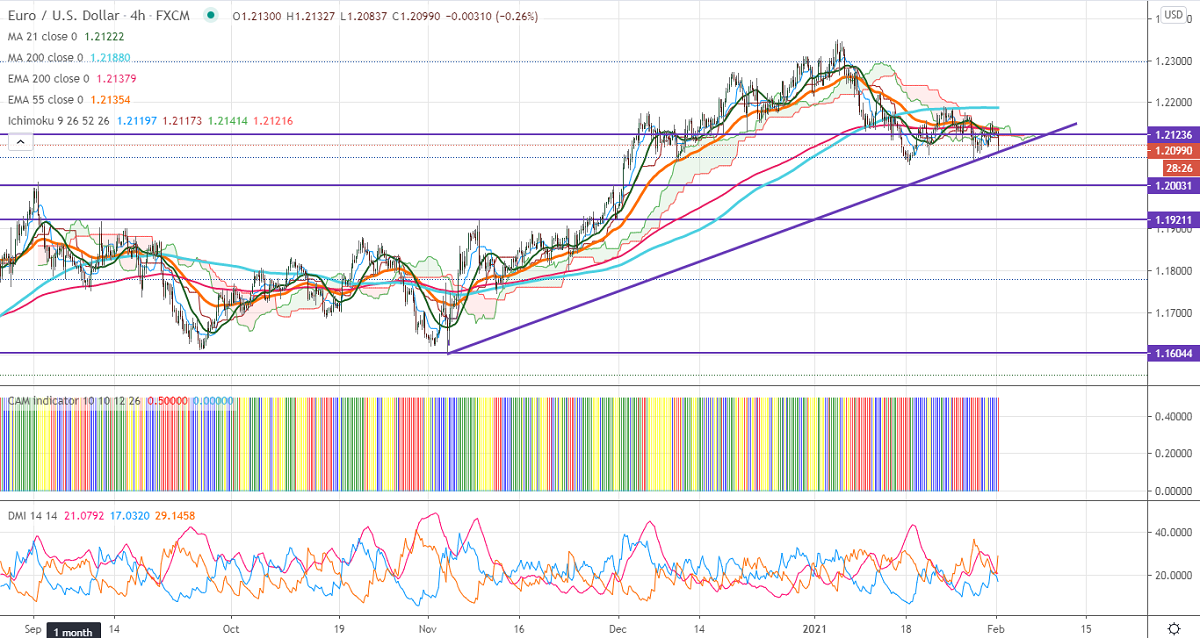

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.21251

Kijun-Sen- 1.21173

EURUSD's upside capped by 200-4H MA and lost more than 50 pips for the day on strong US dollar. The pair showed a good recovery after the ECB unlikely to cut rates further. But huge volatility in the stock market has increased demand for safe-haven like the US dollar. The Eurozone IHS Markit's final manufacturing PMI came at 54.80 in Jan slightly below the previous month's 55.20 also putting pressure on this pair at higher levels. The US 10-year yield rose more than 10% from the minor bottom 1%. The pair hits an intraday low of 1.20837 and is currently trading around 1.20967.

Technical:

On the higher side, near-term resistance at 1.21882 (200-4H MA). Any indicative violation above targets 1.2260/1.2300. The next support is around 1.2080. Breach below will drag the pair down till 1.2050/1.2000.

It is good to sell on rallies around 1.2168-70 with SL around 1.2200 for the TP of 1.2050.