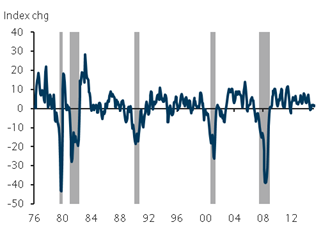

The Federal Reserve's Labor Market Conditions Index (LMCI) rose 1.6pts in October, mirroring the US labor market strength evident in last Friday's October employment report. Monthly estimates for Q3 were revised up by a total of 2.5pts with September now showing a steady gain of 1.3pts (initial: 0.0). As of October, the Fed's measure has made up a little more than 90% of the 2008-2009 deterioration in labor market conditions; the index has now risen a cumulative 334pts through the expansion, versus the 370pt contraction from January 2008 through June 2009. At an average monthly improvement of about 4pts per month, the index is on track to fully recoup labor market losses in about eight months.

The stronger-than-expected 271k rise in October nonfarm payrolls, one-tenth decline in the unemployment rate to 5.0%, and a solid improvement in wage growth to 2.5% y/y all suggest that US labor markets have largely recovered from the August/September slump. Continued labor market improvement is likely to support FOMC members' confidence in the outlook, leading the Fed to begin the process of policy normalization at its December meeting.

"The LMCI uses a dynamic factor model of 19 labor market indicators to extract a single index variable, which is one of the metrics the FOMC uses to assess overall labor market conditions. The release data include only monthly changes in the index; thus, we use changes in the index over the business cycle to understand where labor markets stand", says Barclays.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated