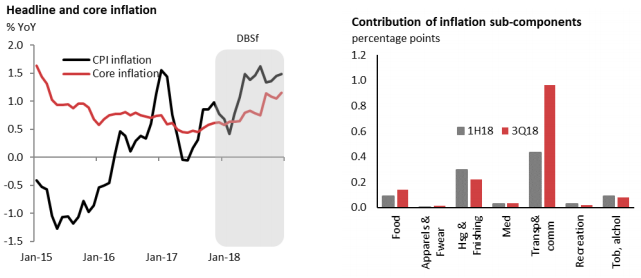

Thailand’s full-year inflation is expected to average 1.3 percent y/y, before rising to 1.6 percent next year on a higher core, according to the latest report from DBS Group Research. Inflation has shrugged off a slow start to the year, lifted by supply-side pressures, particularly high oil prices.

The Bank of Thailand had signaled its readiness to normalize rates, but a hike is not imminent given manageable inflation and a stable currency. Policy tightening expectations might resurface late-2018 and early next as the US continues to hike rates, and the spill-over impact weighs on EM. An upside surprise in Thai growth could also be another catalyst for the BoT to hike in 2019.

Better private consumption demand is being upheld by higher durables, which has helped offset the impact of a slower pick-up in non-durables and weaker service output. Private investment indicators are mixed, with the index in a holding pattern in recent months, whilst capital imports (value terms) moderate at the margin.

Cement sales and commercial pickups have, however, fared well. Rise in non-durables consumption remains modest but is likely to improve as farm incomes rise on higher agricultural output and better prices. Consumer confidence indices are holding up five-year highs.

"The BoT’s move to signal a shift towards a less accommodative policy does not, however, imply an imminent rate hike," the report added.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal