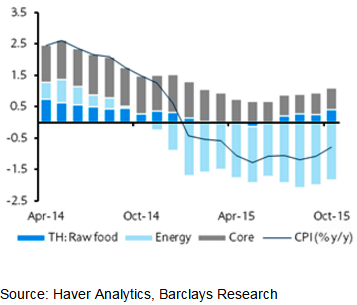

Thailand faces 10th consecutive month of negative inflation. Lower energy prices remain dominant, as core inflation also remained rangebound at 0.95% y/y.

While CPI increased 0.2% m/m after of three months, overall inflation remains manageable and will likely stay in negative territory through 2015.

The energy component of the CPI continued to fall at a double-digit pace on a y/y basis, declining 15.5% in October (September: -15.6%). However, food prices continued to rise, as weather conditions remain poor, and prices of volatile items such as vegetables and fruits increased sharply again in October.

"The CPI inflation is likely to remain in negative territory through 2015 and rise very gradually in 2016. 2015 inflation is forecasted to -0.8%, and the risks are still biased to the downside. 2016 inflation id forecasted at 2.0%, with risks clearly tilted to the downside", says Barclays.

In its recent monetary policy report, the Bank of Thailand also lowered both its growth and inflation forecasts for 2015 and 2016, and now forecasts inflation of -0.9% in 2015, and 1.2% in 2016.

Despite poor domestic growth outlook, the Bank of Thailand is likely to remain on the sidelines later this week. In its last policy statement, the BoT affirmed its stance as sufficiently accommodative, especially if the THB remains generally weak.

However, if growth slows further, the risks of further accommodation will rise. Given the forecast that the US Fed will not increase rates until Q1 16, as well as signs of weakness in China and the ASEAN countries, the BoT will continue to monitor the domestic data for signs of weakness.

"In August, the growth was forecasted to 2.7% for 2015, and there are downside risks to our forecast, given risks of moderation in tourism and poor weather conditions", added Barclays.

Thailand's CPI inflation likely to remain in negative territory through 2015

Monday, November 2, 2015 5:32 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed