Consumer inflation in Thailand is expected to remain below the central bank’s target range at least until mid-2018, unless investment in the private sector starts to surprise on the upside.

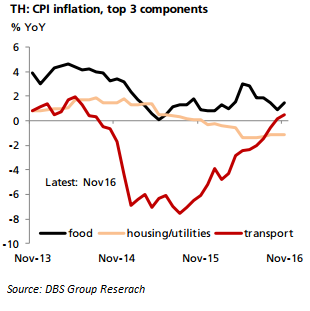

Transport inflation came in at 0.5 percent y/y in November, fastest since mid-2014. Having seen the end of this year’s low oil price distortion, transport inflation is expected to continue trending higher into 2017, DBS reported.

This will in turn pull up overall CPI inflation higher to about 1.5 percent in 2017, even if food inflation were to remain orderly at 2 percent pace next year. Transport and food make up 54 percent of the total CPI basket.

The Bank of Thailand (BoT) is set to keep its policy stance accommodative for now, particularly since the central bank would presumably want to see inflation rising faster going forward. This is not an easy task though. One reason to explain the low headline inflation is the prevailing weakness in domestic demand. Core inflation continues to grow at 0.8 percent trend, some distance away from the 2-3 percent normal trend.

"We reckon that transport inflation will average about 2 percent next year," the report said.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal