Thailand’s gross domestic product (GDP) for the first quarter of this year significantly outperformed the market’s expectations. It increased 4.8 percent y/y (2.0 percent q/q sa). The quarterly rise was the fastest since Q4 2012.

Equally important is that the acceleration was broad-based, putting to rest concerns that Thailand’s recovery is lacking breadth. However, the strengthening growth trajectory is not as yet been accompanied by rising inflationary pressures and therefore, monetary policy can remain accommodative, according to the latest report from ANZ Research.

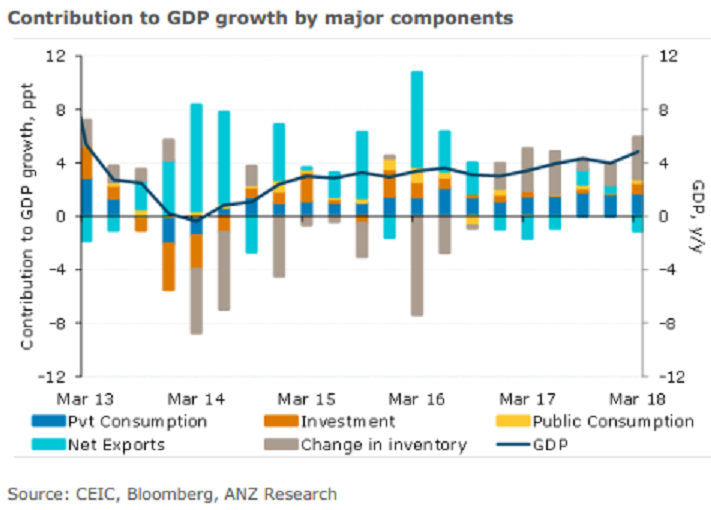

The breadth of the acceleration in growth was the most notable feature of Q1 GDP data. Barring exports which slightly moderated to 6 percent y/y from 7.4 percent y/y previously, all other components accelerated during the quarter. Private consumption strengthened to 3.6 percent y/y from 3.4 percent y/y previously while investment recorded growth of 3.4 percent y/y. For full-year 2017, investment had increased by a meagre 0.9 percent y/y.

From the supply side, agricultural output (including fishing) expanded 6.5 percent y/y, reversing a contraction of 1.3 percent y/y in the previous quarter. This turnaround presumably resulted in higher incomes and consumption in the rural sector. Growth in non-agriculture GDP remained unchanged at 4.7 percent y/y.

"This strong performance has come in an environment of benign inflation, implying that monetary policy can stay accommodative. Thailand’s growth-inflation mix remains favorable," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm