Crude oil prices fell by nearly 50% since summer of last year.

- With the fall, governments are going to bear large portion of the pain as tax revenue is expected to dwindle.

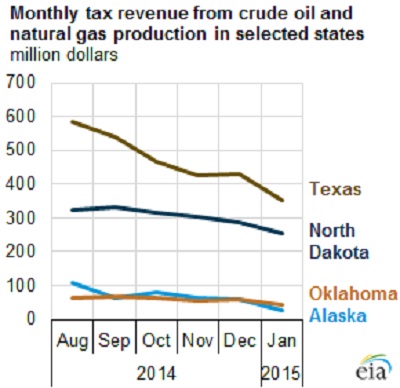

- Latest chart from EIA, explains the situation for the US government.

- Tax revenue fell from near $ 600 million in August 2014 to $ 350 million in January 2015 for Texas alone. For North Dakota, revenue hovered around $ 250 million down from above $310 million for the same period. Picture is similar across other regions like Oklahoma and Alaska where revenue fell more close to 50%.

- Situation would be similar across world and more painful for countries like UK, Germany, and France where the taxes are much higher than that of US.

- Oil exporting nations like Oman, Kuwait, and Venezuela and Norway situation is a bit more severe.

Good news -

- Companies might be having a better time despite the fall except the smaller ones and shale players. During the time of high price they face pressure from governments for more taxes and workers for pay hike which actually puts pressure on margins.

- Large companies will enjoy bargains as assets are comparatively cheaper priced for takeovers.

Large oil producers will stand through this recent storm like they did in the past and this may be good time for value investors to make investments as price runs cheap.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate