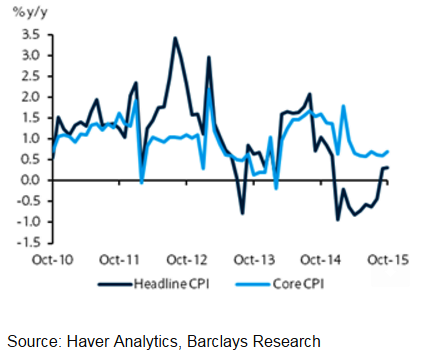

Taiwan's inflation bottomed in April and is likely to bounce back due to the lower base effects of oil price fall. October inflation climbed to 0.31% yoy, which was above expectations. The main contribution to the inflation were food, petrol prices drag and retail pump prices.

The improved inflation outlook and growth bottoming in Q3 should also give the central bank more comfort to keep its monetary stance unchanged at its December meeting. In the absence of a clear systemic shock and with the US Fed considering a December rate hike, the CBC might keep its benchmark interest rate unchanged at its December meeting.

"Taiwan's growth is likely to have bottomed in Q3 and will expand modestly in Q4 - on the back of a late-year pickup in external demand. We recently lowered both our 2015 and growth forecasts by 20bp to 0.8% and 2.5%, respectively", says Barclays.

Further easing also has some possibility, if exports continue to weaken on a sequential basis in Q4. CBC is likely to maintain excess liquidity at a slightly higher range in the coming months.

"2015 inflation is forecast to -0.2% y/y. The 2016 inflation forecast is unchanged at 1.7% y/y. Overall, the miss was driven by still elevated food prices, as we had expected food inflation pressure to subside more quickly", added Barclays.

Taiwan inflation trends higher

Thursday, November 5, 2015 6:02 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed