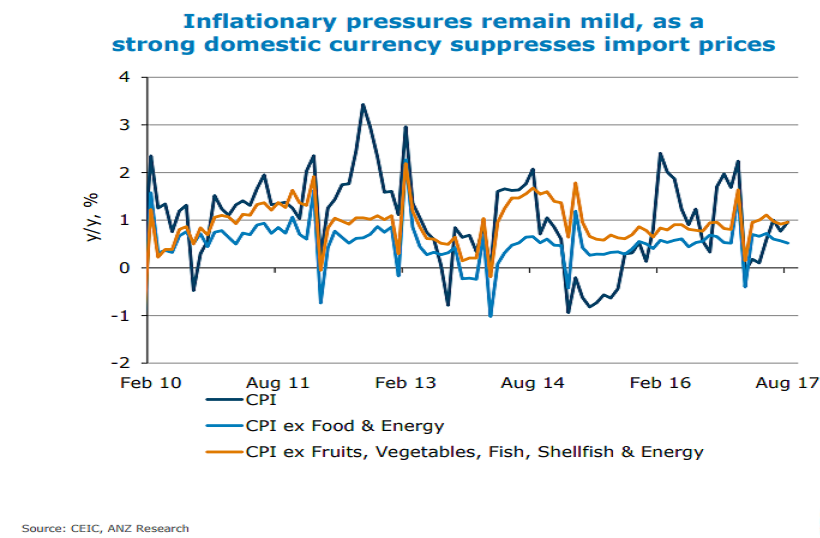

Taiwan’s consumer-price led inflation index (CPI) is expected to remain around 0.5 percent y/y till end-2017. An expected pay rise in civil servant and corporate salaries could further, provide a mild boost to CPI in 2018, ANZ Research reported.

Currently, the country’s CPI remains stubbornly low with a strong domestic currency suppressing import prices. August’s CPI rose by 0.96 percent y/y. CPI has risen by an average of just 0.5 percent since February 2017. With growth picking up only gradually, inflation is expected to remain benign in Q4 2017.

In the absence of a strong labor market recovery, wage growth is also unlikely to provide much impetus. The CBC kept the policy rate unchanged at 1.375 percent at its September meeting. It has been more than a year (June 2016) since the central bank made a cut.

"The decision is consistent with our view that the policymakers have switched to a wait-and-see mode and will only act if there is a massive change in the global financial situation. We expect the CBC to stay on hold over the next 12 months," the report said.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility