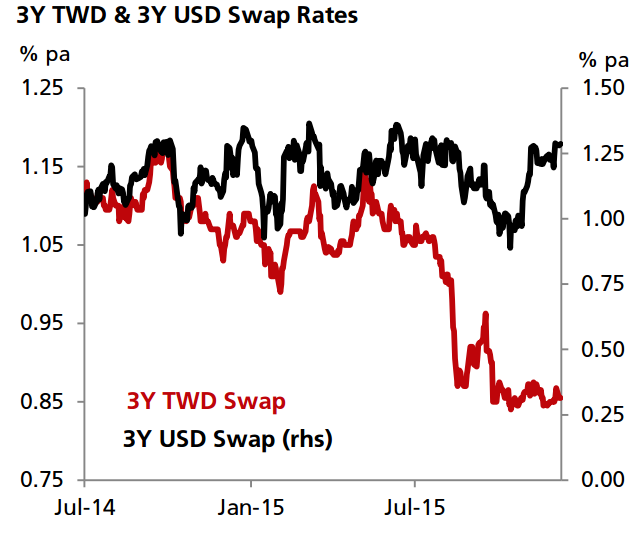

TWD market rates have become increasingly decoupled from USD rates. Previously, spikes in USD rates nudged 2Y and 3Y TWD swap rates higher. However, the correlation broke down in recent weeks even as the market starts to price in Fed normalization more aggressively. Much of this has got to do with significant pessimism on the Taiwanese economy over the medium term. The economy registered two consecutive quarters of negative growth (2Q and 3Q) and still faces considerable cyclical and structural headwinds. Both external and domestic demand growth have been anemic.

Against this backdrop, the economic outlook divergence between Taiwan and the US is likely to translate into monetary policy divergence. From 2004- 2006, the Central Bank of the Republic of China (CBC) paced the Fed in the rate hike cycle, albeit at a more moderate pace. For the coming few quarters, the CBC is likely to keep an easing bias even as Fed normalization begins. In contrast to previous cycles, rising USD rates are not likely to place much upward pressure on TWD rates.

"We expect TWD market rates to remain broadly stable over the coming four quarters", notes DBS Group Research.

TWD rates decoupling from USD rates

Wednesday, December 9, 2015 3:03 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX