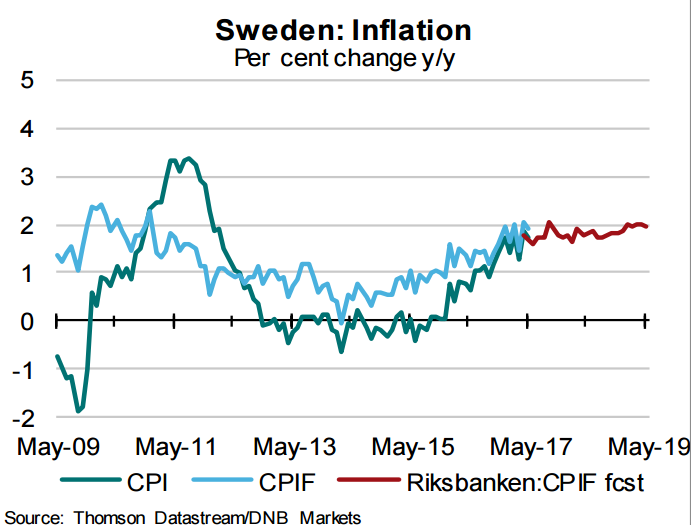

Sweden's CPIF gauge of inflation came in at 1.9 percent year-on-year in May, as compared with the Riksbank’s projection of 1.7 percent and consensus expectations of 1.8 percent. CPIF, excluding energy was 1.6 percent year-on-year, which is 0.3 percentage point higher than the Riksbank’s view. Swedish CPIF inflation slowed less than forecast in May and continued to be close to the target rate of 2 percent.

Inflation gauged by the consumer price index remained at 0.6 percent on a sequential basis, whereas it slowed to 1.7 percent year-on-year. The year-on-year figure came in above Riksbank’s projection of 1.5 percent. Foreign travelling prices again surprised on the upside, positively contributing 0.09 percentage point to the headline inflation. Furthermore, prices for services rose more than anticipated, while food prices were low in the month.

The central bank has been struggling to keep inflation around its 2 percent target level in recent months, encouraging it to reiterate its commitment to negative interest rates and quantitative easing. Today's upbeat data is welcomed by the bank and makes more stimuli measures less likely, noted Nordea Bank in a research report.

That said, any turnaround in the central bank’s monetary policy stance is still a long way off as currency moves can have a big impact on inflation in the trade-dependent Swedish economy. The krona appreciated 0.75 percent to 9.7240 per euro after strong inflation figures. And the central bank has made clear that it is reluctant to risk a rapid strengthening in the krona by raising interest rates sooner than the European Central Bank.

"Inflation has been hovering close to, but below target the last months. However, Riksbanken has already announced that it will extend APP in H2 and that inflation is still very dependent of expansionary monetary policy to stabilize at target. Hence, we need more than a couple of observations at target for Riksbanken to be happy," said DNB Bank in a report.

EUR/SEK was consolidating previous session downside, trading at 9.7451 at 1200 GMT. Strong support seen at 9.6783 (50-day MA). Weakness likely on break below. Trend in the pair remains bullish. FxWirePro's Hourly EUR Spot Index was at -8.07428 (Neutral) at 1230 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record