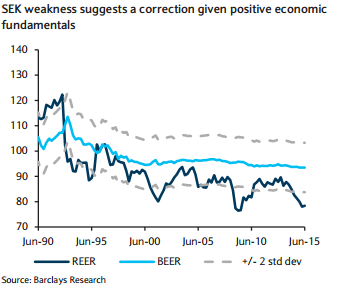

Finally, further easing is unlikely on rising financial stability concerns related to a prolonged period of low (or even negative) interest rates. Swedish household debt exceeds 85% of GDP and equates to more than 160% of household disposable income.

As such, measures to reduce vulnerabilities and risks in the household sector will likely be rather time consuming, implying an increasingly cautious monetary policy stance in the meantime and likely benefiting the SEK.

Sweden financial stability concerns likely keeping policy stable

Monday, June 29, 2015 11:10 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022