As we head into policy meetings from the ECB and SNB scheduled on 12 March and 17 March respectively, with the rates market pricing 12bp cuts for both central banks, we can expect some EUR/CHF downside if ECB cuts but SNB does not. SNB ought to be able to handle a mild disappointment reaction and President Jordan highlighted during a speech at the G20 summit on Saturday that the central bank has not run out of policy tools. He sent out a strong signal that "both the interest rate and the size of the exemption threshold are policy variables that the SNB has".

"So far we do not plan any change, but of course the exemption threshold is a possible policy instrument," Jordan was quoted as saying while at the Group of 20 meeting in Shanghai.

The main driver of recent CHF strength appears to be twofold: 1) widespread expectations for deeper negative policy rates from the ECB and 2) UK's referendum on EU membership which is probably the significant global risk event this year. Sustained upward pressure on the CHF is likely ahead of the event and this increases the likelihood of SNB action. The SNB hopes its policy of negative interest rates and currency market purchases will weaken the CHF, which it has repeatedly described as significantly overvalued.

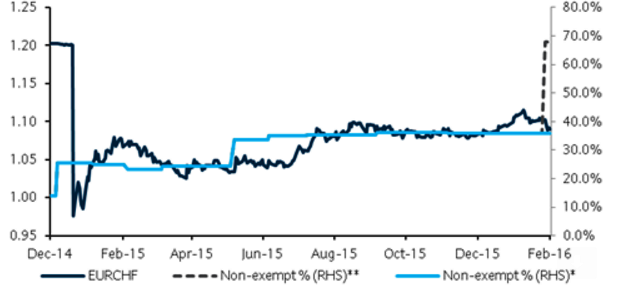

Currently, deposits greater than 20 times individual banks' minimum reserve requirement are being charged a rate of -0.75 percent. Only 36% of sight deposits are subject to negative rates, which amounts to less than 5% of banks' total assets. Lowering the exemption threshold could help to make the franc, seen as a safe haven currency in times of market turmoil, less attractive to investors.

"Given the magnitude of such policy action, we continue to highlight jump risks for the CHF and recommend owning low-delta, out-of-the-money topside option structures in EUR/CHF or USD/CHF to take advantage of the skew in both cases", says Barclays in a research note.

However, the SNB knows measures such as changing exemption thresholds are unlikely to impact the currency materially or quickly and hence are unlikely to be a solution that SNB chooses in March. Expectations are that the SNB will use large FX interventions alone rather than needing to cut interest rates. Any surge in the CHF's value that cannot be countered with intervention, due either to increased expectations for further ECB easing or a jump in the "Leave" vote in UK polls, could precipitate an inter-meeting move by the SNB.

"The SNB's first step is likely to be increased FX intervention. However, if intervention fails to stem CHF appreciation, the nuclear option (exemption from negative deposit rates) appears likely", adds Barcalys.

EUR/CHF was trading at 1.0906 as at 1010 GMT, continuing its downtrend from yearly highs of 1.1199 hit on Feb 4th. USD/CHF was trading at 0.9998.

Sustained downside pressures on EUR/CHF could see SNB action ahead of its 17 March meet

Monday, February 29, 2016 10:16 AM UTC

Editor's Picks

- Market Data

Most Popular

5

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist