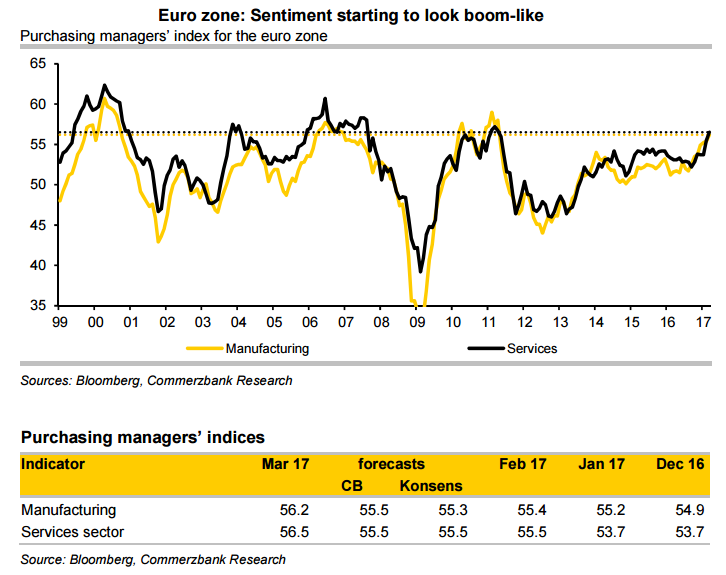

Eurozone economic growth gathered further momentum in March, bolstering optimism over the region in the face of Brexit. Businesses across the euro zone ramped up activity at the fastest pace in almost six years, a survey by IHS Markit showed. Eurozone Markit's flash composite PMI rose to 56.7, from 56.0 in February, defying median expectations in a Reuters poll for a fall to 55.8.

"The increasingly broad-based nature of the upturn also bodes well for strong growth to be sustained in coming months. While elections remain a worry regarding the outlook, for now, the business mood in France and across much of Europe is very positive,” said Chris Williamson, Chief Business Economist at IHS Markit.

Both manufacturing and service sector firms responded to surging order books by rising hiring. Employment showed the largest monthly improvement since July 2007. Service sector job creation was the best seen since October 2007, and factory payrolls were added to at a pace not seen since April 2011.

Price pressures also continued to pick up. A sub-index measuring prices charged rose to a near six-year high of 53.3. Average prices charged for goods and services rose at the steepest rate since June 2011. Some evidence of rising wage growth and supply chain price pressures was also seen.

Earlier this month the ECB pledged to extend its bond-buying program to at least the end of the year, citing weak underlying inflation and lacklustre growth in the euro zone. The stellar preliminary ‘flash’ PMI reports earlier today for France, Germany and the Eurozone as a whole suggest acceleration in Q1 economic growth. The ECB has already indicated that it will reduce its monthly asset purchases from €80bn to €60bn, starting from April. There are also indications that the ECB is considering tweaking its forward guidance on interest rates.

"Upbeat PMI data should provide fresh fuel for the rate hike speculation that has emerged recently, as the high sentiment readings suggest that economic growth is stronger than forecast by the ECB. Yet, the ECB may hesitate to revise its economic outlook upwards, because the euphoric sentiment is not underpinned by hard data – at least at this juncture," said Commerzbank in a report.

EUR/USD was trading at 1.0805 at around 1050 GMT. The major was struggling to extend gains above major trendline resistance currently at 1.0825. Break above could see test of 200-DMA at 1.0886. On the downside, the pair finds strong support at 1.0660 (20-DMA). FxWirePro's Hourly EUR Spot Index was neutral at -1.56639. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic