In what was a unanimous vote, the Federal Reserve on Wednesday, kept the target range for the fed funds rate unchanged at 0.25-0.50% range. FOMC formally kept the door open to a March hike but did not communicate anything explicitly at this meeting. It was notable that the Fed was no longer willing to describe the risks to the outlook as balanced.

While saying 'labour market conditions improved further', the Fed recognised that 'growth slowed' in Q4 15, a shift away from December statement which said 'expanding at a moderate pace'. However, the committee noted that this was partly due to slower inventory investment. The statement said household spending and business fixed investment were still increasing at 'moderate' pace compared to 'solid' in December.

The FOMC left the policy guidance paragraph unchanged, sticking to the "gradual" notion of future rate hikes as expected. The Committee highlighted that it will monitor economic and financial events globally - presumably for any potential downside risks. This shows that the Fed takes the financial market turmoil and the development in China and other emerging markets into account.

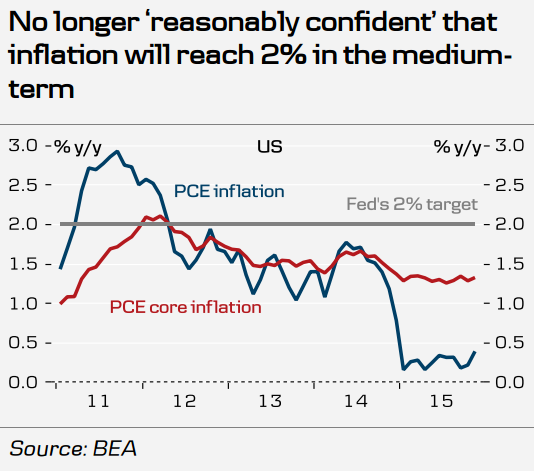

Global headwinds, the strong dollar and low oil prices are likely to have negative effects on US inflation, a concern the Fed doves had at the time of the December hike. This means that it will be more difficult to reach consensus on another hike in the near term. Therefore we do see possibilities for the next hike before the June meeting.

"We stick to our view that the Fed will increase the Fed funds target rate three times this year (April, September and December). However, we still believe there are downside risks to this call, as the Fed will not risk tightening too much, too quickly, in our view," notes Danske Bank in a research note to clients.

Market is now pricing a 20% probability of a hike in March, compared to 10%-points from before the meeting. Despite the global headwinds the US services sector continues to grow and produce jobs at a strong pace, reducing labor market slack and bolstering the Fed's confidence in the inflation outlook. The actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

US front-end rates pared their pre-meeting gains and the USD lost ground as well. Equity markets also traded in the red in response to a less hawkish message. At 1110 GMT today, EUR/USD was trading at 1.0909, while USD/JPY was at 118.87.

Subdued core inflation could force the FOMC to stay patient, next hike unlikely before June

Thursday, January 28, 2016 12:00 PM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate