The European Central Bank (ECB) rate decision looms next Thursday, 20th September and analysts expect the central bank to keep policy unchanged and wait until December to unveil a possible extension and tweaks to its Quantitative Easing programme. President Mario Draghi's presser will be scrutinized closely as investors assess both the scope for further easing and eventual tapering.

A Bloomberg report earlier this month, which said that the ECB “will probably gradually wind down bond purchases before the conclusion of quantitative easing" roiled Eurozone bond markets. However, minutes of ECB September 8th meeting released thereafter dampened market speculation. Minutes showed that the central bank is committed to maintaining its massive bond-buying program until its conclusion next year and stands ready to extend it, if necessary.

"Rhetoric will be very important this week. Draghi will try to play down the taper talk and may give some hints on what to expect in December." said Martin Van Vliet, senior rates strategist at ING.

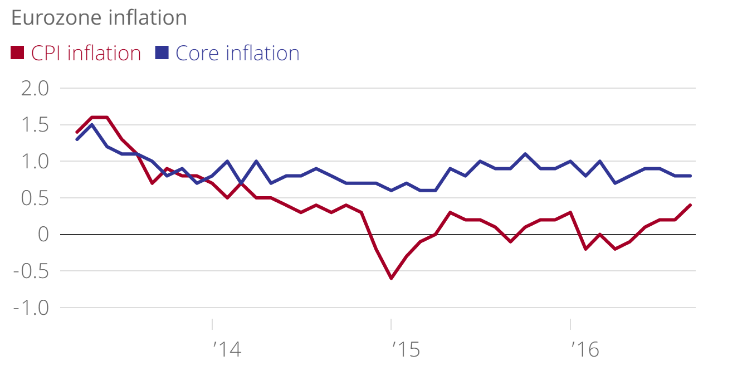

Data released by Eurostat earlier on Monday showed that final Euroarea annual inflation was confirmed at 0.4 percent in September 2016, up from 0.2 percent in August. In the larger European Union, annual inflation was also 0.4 percent, up from 0.3 percent in August and compared to -0.1 percent a year earlier. Core inflation, however, has failed to break through the one percent barrier. It came in at 0.8 percent in the year to September, the same level in August.

ECB chief Mario Draghi will be under pressure this week to clarify the bank's stimulus plans after talks of possible stimulus taper spooked investors. The ECB strongly denied the speculation but markets were rattled nonetheless. Despite some positive signals in recent months, Eurozone growth has remained sluggish and inflation stubbornly low. The ECB targets an inflation rate of "below, but close to" two percent - a level which it has not hit since the beginning of 2013.

"Stubbornly weak Eurozone core inflation and likely ongoing lackluster economic activity suggest to us that the ECB will have some more work to do," said Howard Archer, chief economist at IHS Markit.

EUR/USD flirting with highs near 1.10 post-CPI data. The major rebounded from multi-month lows in the 1.0965/60 range seen last week. It was trading 0.22 percent higher on the day at 1.0996 at around 11:30 GMT. The pair’s immediate resistance stands at 1.10670 and any break above will take the pair to next level 1.1100/1.1170 (200- day MA). On the lower side support stands at 1.0950 (Jul 26th low) and any break below that level will drag the pair till 1.0900/1.08350 in the short term.