The Bank of England (BoE) raised its key rate by 25 bp to 0.50% for the first time since 2007. In addition, the central bank left the asset purchase facility unchanged at £435 billion and the purchases of corporate bonds at £10 billion. The Monetary Policy Committee (MPC) voted 7-2 (Cunliffe and Ramsen being the dissenters) favouring higher rates and 9-0 in favour of keeping the bond-buying programme intact.

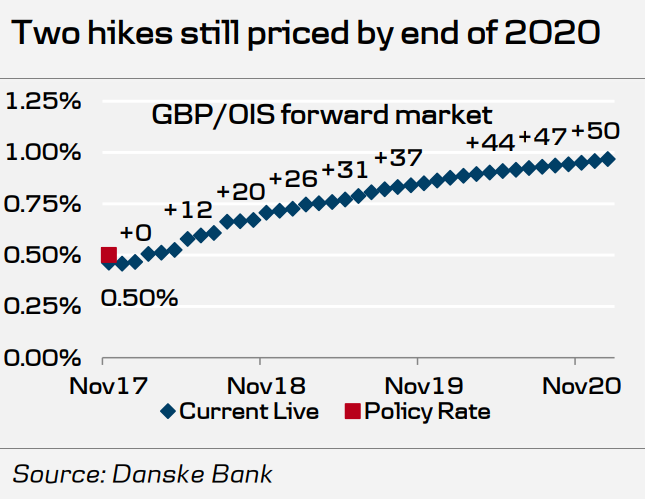

The minutes and policy statement that accompanied were possibly the most downbeat, having no indication that further hikes are on the near-term horizon. The central bank did not comment on rate path (current market pricing two hikes over three years), meaning the BoE keeps its flexibility and said that it will ‘monitor closely’ incoming data.

It is clear that Brexit remained the key risk to the UK outlook and hence the main challenge for the MPC. The minutes noted that “the decision to leave the European Union was already having a noticeable impact on the economic outlook” while “uncertainties associated with Brexit were weighing on domestic activity. The market is now pricing-in the next hike for August next year.

The central bank also published the "Bank of England Inflation Report November 2017," which showed the MPC’s outlook for inflation and activity remained broadly similar to its projections in August. The MPC still expects inflation to peak above 3.0% in October, as the past depreciation of sterling and recent increases in energy prices continue to pass through to consumer prices.

"We still believe the BoE will stay on hold in 2018 and not hike again before 2019.With the next rate hike priced by November 2018, we see market pricing as slightly on the hawkish side. Longer term, Brexit negotiations remain the key determinant for GBP. We target 0.87 in 6M and 0.86 in 12M," said Danske Bank in a report to clients.

GBP/USD plunged over 1.75% to close below 100-DMA at 1.3079 on Thursday's trade. The pair is consolidating previous session's slump, is currently trading a narrow range, capped below 100-DMA. Technically, pair is trading slightly below 1.3070 low made on Oct 27th 2017 and any break below 1.30270 (Oct 6th 2017) will drag the pair till 1.2780 (233-day MA). Near-term resistance is around 1.3080 (100-day MA) and any break above will take the pair till 1.3130/1.3175 (55-day EMA)/1.3230. Minor trend reversal only above 1.3380.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell