GBPUSD overview: The reversal higher yesterday has held intra-day resistance in the 1.3445/55 region. A run back through here would open a stronger move towards 1.3540-1.3590. However, the 1.37-1.39 region is seen as significant resistance and expect a broader pullback from this region towards 1.30-1.25. Stepping-stone supports sit at 1.3350/30 and 1.3245/35 ahead of this target region. A close above 1.39 would force us to review our underlying medium-term outlook for a range around 1.30 to develop.

Nevertheless, EU leaders are considering going some way to meet one of the U.K.’s demands, signaling a minor breakthrough in Brexit talks after three months of scant progress.

While the European Parliament will call on leaders not to move talks on to the crucial trade deal at a summit next month, according to a draft resolution, European leaders are considering bringing forward talks on the transition period that will follow Brexit, according to people familiar with the situation. The concession on transition would happen at the EU summit in October, where leaders may discuss changing the mandate of chief negotiator Michel Barnier to allow him to talk about the bridging arrangements alongside the divorce, according to the people.

Well, we had explicitly advised in our recent post titled “FxWirePro: Has Sterling really responded to hawkish BoE? What causes acceleration in GBP rallies? FX OTC setup to unearth fact from fiction” that not to blow out of the proportion with GBP spikes and jump the guns with massive long build-ups.

Where we also stated that with Brexit negotiations dragging on, we still see downside risks for the pound.

Only once the future relationship between the UK and the EU starts to gain shape do we see room for a sustained recovery of GBP exchange rates.

Even with uncertainty over Brexit negotiations ongoing, the pound gained in September. This was due to the Bank of England (BoE) signaling a rate hike on the back of increasing (core) inflation.

Initially, however, we only see scope for one rate hike, which is unlikely to be sufficient to send the pound higher on a sustainable basis.

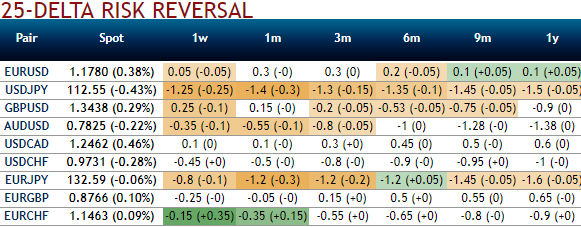

Please glance through the above nutshell showing the risk reversals and be informed that the recent shift hedging sentiments have again turned onto downside risks.

As mentioned earlier, the more significant policy repricing in the past two weeks was in the UK, and the resulting 3% rise in GBPUSD certainly was a drag on the magnitude the USD index was able to rise on its own policy repricing and explains why the DXY index (where GBP has a 12% weight) failed to advance in the past two weeks in spite of the Fed story.

Therefore, the downside risks to the pound will predominate for now. Both the ECB and the Fed are likely to tighten monetary policy before year-end, which is why the pound looks set to lose both against the EUR and the USD. This is also evident if you look into the positively skewed implied volatility of 6-months tenors.

Long term, our studies suggest the bear trend that started back in 2007 at 2.1160 is in its last phase. Recent price action increases the chance that 1.1490 was a major long-term low. Even so, there remains a risk of a return to the low 1.20s and possibly a re-test of the spike lows in the next two years.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices