Societe Generale notes:

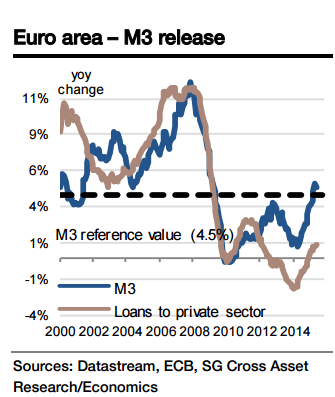

Significant improvements have been seen in monetary and credit dynamics since the ECB adopted an accommodating stance back in June (rate cuts, TLTRO, QE). Indeed, M3 money supply growth recovered from a lacklustre 1.1% yoy in May 2014 to a buoyant 5.3% yoy in April 2015, above its reference value of 4.5%. In May, monetary dynamics showed signs of stabilisation, with money supply rising by 5.0% yoy. We expect this trend to have continued in June, with money supply having probably risen by 5.1% yoy (bringing the 3-month average to 5.1%).

The results of the ECB's July Bank Lending Survey showed that actual loan demand from firms is not strong yet on the back of a weak recovery in investment, high corporate debt levels and growing uncertainty related to the Greek situation. We therefore expect the improvements in monetary dynamics to support higher asset prices rather than higher real GDP growth in the short term. Medium term, there is a good chance that the improvement in the outlook will give companies sufficient confidence to start investing and hiring again.

Stabilising improvements in Euro area monetary and credit dynamics

Sunday, July 26, 2015 11:51 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022