Technical updates:

The currency cross has taken support and began bouncing back exactly at 100% retracement soon after breaching the lower channel line at 1.52 levels.

As shown in the daily graph the pair had breached lower channel line at 1.553 levels and made cent percent retracement up 1.52 levels started showing strength of reversal.

To fortify this view oscillators signal the positive convergence to the price curve and on weekly graph formation of bullish spinning top candle at bottom to confirm the trend reversal.

RSI (14) is trending at 48.6486 levels.

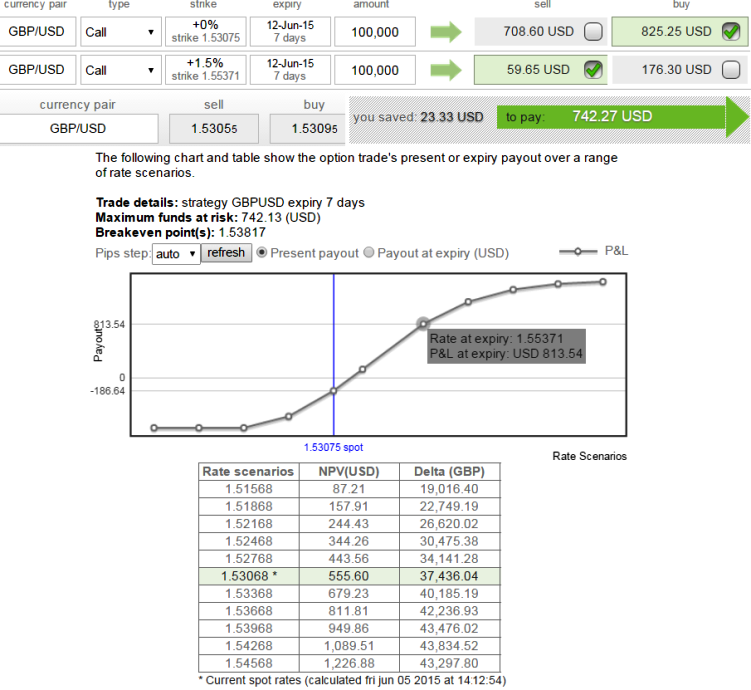

Currency Options Insights: Using ATM call on Bull Call Spreads keeps Delta on safe.

As a sense of bull trend is anticipated, we would like to advocate Bull Call Spreads using At-The-Money calls at this stage.

Delta of ATM calls of GBP/USD that represents the option's equivalent position in the underlying market flashes at 50074.8 for 100,000 units which means 0.5.

Delta remains in positive zone at 37436.07 even after this strategy formulation while it contains shorting on one side.

With a simple logic, positive delta for option holder indicates desirable direction of underlying currency fluctuation.

Hence, we believe at this juncture of current currency momentum, ATM calls in call spreads of this pair for hedgers looks appropriate.

Spinning top on GBP/USD indicates trend reversal, Add ATM calls on BCS

Friday, June 5, 2015 8:56 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand