Well, the much awaited Fed's stance was finally as dovish as they could be, there are certain concerns about a tail risk scenario developing in Asia. The scenarios are going along with the following channels, when the Fed hikes, US interest rates rise, the USD rises, Asian debt is sold off, Asian corporates are forced into buying USDs to redeem debt, resulting the USD higher, and in turn tightening monetary conditions further, and so on.

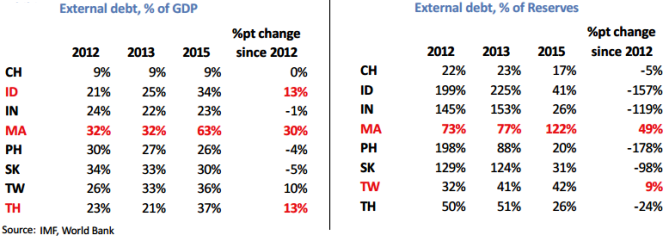

MYR the most worrying among Asian currency crosses, bear monitoring metrics such as short-term external debt to GDP and short-term external debt to FX reserves are key indicators of an economy's resilience to external shocks. Malaysia stands out as having the weakest metrics as you can observe from the above diagram briefing evolution of these debt metrics since 2012.

IDR and THB have both seen a noticeable rise in external debt as a percentage of GDP, but the overall ratios remain relatively low at 34% and 37%, respectively. Likewise, Taiwan's reserve cover has deteriorated since 2012, although overall coverage has yet to reach concerning levels. Not only has external debt almost doubled as a proportion of GDP, but reserve cover has also deteriorated sharply.

With a Fed hike around the corner is likely to prolong for another 2-3 months, the spotlight shifts back to the spillover effects on Asian economies. This time, however, we expect a Fed rate hike to have a very different impact on the relative performance of Asian FX. MYR, IDR, TWD, and KRW are the most vulnerable to higher US rates and a higher USD. On the other end of the spectrum, RMB, INR, and PHP appear to be in the strongest positions.

Spillover effects of Fed’s rate decision on Asian FX baskets, MYR under stress

Friday, September 18, 2015 1:21 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate