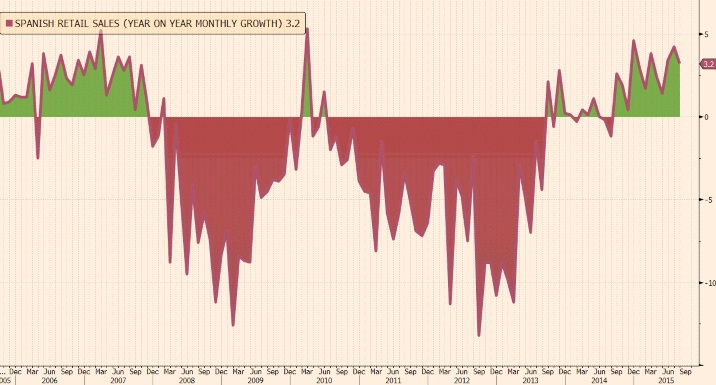

In spite of not living up to the expected growth of 3.3% y/y and that of July of 4.2%, Spanish retail sales managed to grow 3.2% y/y, which makes the consecutive growth of retail sales, longest since crisis.

In August, retail sales climbed 3.2 per cent year on year. Such a long run of expansion has not been seen since before the crisis. Chart courtesy Financial Times.

This year Spanish economy has been showing resilience, however Spanish assets namely stocks and bonds underperformed European peers as two election (election in Catalonia, general election) weighed on sentiment.

However since Catalonian is done with last Sunday, Spanish assets have finally started catching upto their European counterparts. General election is scheduled for December, where current incumbent Prime Minister Mariano Rajoy is likely to have tougher time.

His only hope is that Economy recovers fast enough by the time so that his party can claim victory of the imposed austerity, however unemployment still hovering above 20%, it won't be easy to convince people for another term in office.

Spanish benchmark stock index is currently trading at 9450, up 0.5% for the day.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?