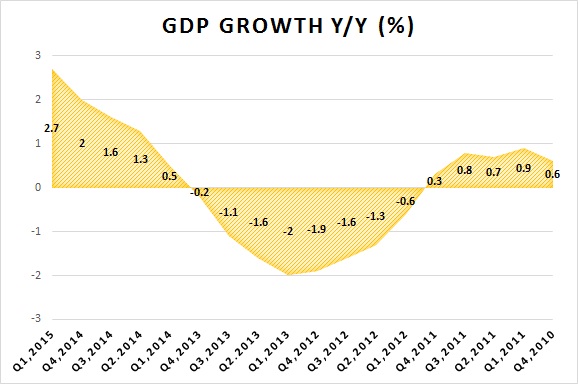

Today Spanish first quarter GDP release showed that growth momentum further picked up in Europe's fourth largest economy. After Ireland, Spain is proving to be another shining star in Euro zone.

- In the first quarter GDP rose by 2.7% from a year ago. Quarterly growth was 0.9%. Retail sales grew too by 4% in April from a year ago, as sentiment improved. It can be declared that growth crisis is over for Spain.

European Central Bank's (ECB) asset purchase program coupled with meaningful reforms have brought Spain back in growth trajectory.

Spanish unemployment still among the highest in Euro zone around 24% and youth unemployment around 40%. More people are expected to join the workforce as recovery gathers pace. Expect unemployment drop sharply in Spain.

Market impact-

- Not much impact on Euro, since the common exchange rate is product of 19 economies not Spain alone.

- Spanish assets remain attractive, especially the real estate. A recovery would increase demand for both residential and commercial properties. Expect Spanish stock exchange IBEX35 to perform well over the medium to longer term.

- Spanish benchmark, IBEX is trading at 11370, far from its pre-crisis high around 16000.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand