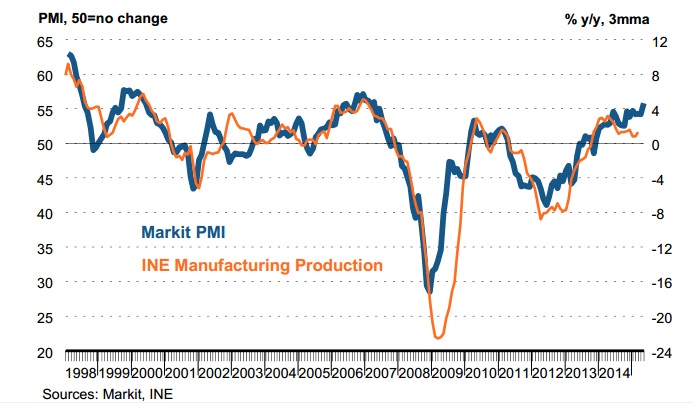

Spanish manufacturing sector gathered further pace in May, as evident from Markit manufacturing PMI.

Spanish assets still remain significantly lower priced compared to pre-crisis level, thus presents excellent opportunity to benefit from as recovery in Euro zone's fourth largest economy is expected to exert upward pressure on country's asset prices.

- Headline PMI data reached 55.8 mark, surpassing 54.2 in April. This is the strongest reading since April 2007.

- Rate of growth in new orders reached highest in eight years. New business orders from abroad rose for 25th consecutive months.

- Businesses are planning to increase hiring.

- Manufacturers raised the output prices for the first time in five months, as input costs have been rising for them.

Expect Spanish real estate market and Spanish stock market to do well over the next few quarters. Though rate hike by Federal Reserve might pose some challenge in the near term.

Spanish benchmark IBEX35 is trading 11250, resistance lies at 11650 and support at 10900.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?