Spain's improving financing and credit conditions will remain supportive of growth. SME funding and new credit to households continue to grow. Gross household loans rose 3.2% in April and SME loans (up to EUR1mn) grew above 10% y/y. The better lending dynamics in part reflect the improving asset quality of banks - the non performing loan ratio dropped to 11.4% in May from 12.5% at the end of 2014. Sovereign funding costs remain very low.

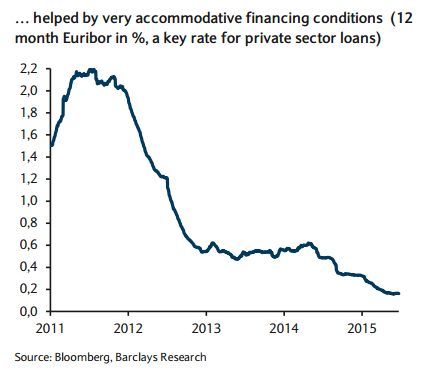

The average interest rate on public debt issued by Treasury in 2015 is 0.9% - the lowest on record. More important, the very accommodative ECB monetary policy stance is expected to continue to support extraordinarily low financing costs for the private sector. The 12-month Euribor, the key rate for (almost) all Spanish mortgages, has averaged YTD 20bp (some 200bp lower than the 2012 peak-crisis level) and is unlikely to materially increase in 2015-16 as the liquidity surplus in the EA is expected to remain ample under the ECB's QE programme.

Nearly all the relevant indicators are now signalling a recovery in the housing sector. House prices have now printed four consecutive quarters of positive growth (INE), following a peak-to-trough drop of 35% in average prices. Although the stock of unsold units will likely remain elevated (at more than 500k) for an extended period, real estate investment has turned positive (somewhat surprisingly) since end-2014, albeit from a low base.

Spain: Improving financial conditions and housing market

Wednesday, July 22, 2015 11:34 PM UTC

Editor's Picks

- Market Data

Most Popular

7