South Korea's inflation ticked higher to 0.7% y/y in June (May: 0.5%; April: 0.4%), in line with consensus but below the forecast (0.8%). The pickup is consistent with the view that inflation bottomed in March-April at 0.4%. Similar to May, the increase was largely driven by food prices on the back of the severe drought.

Indeed, the Korea Meteorological Administration said on 15 June that accumulated rainfall YTD in Seoul, Gyeonggi-do and Gangwon-do provinces was only half of an average year. The oil drag remained in place, but the distortion has eased given that the retail pump price has rebounded 12.2% since February's low.

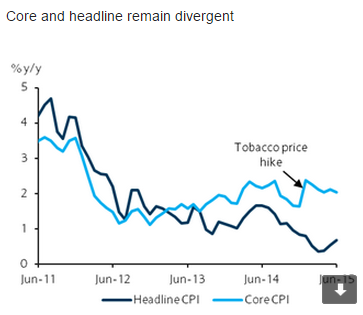

All told, there is still no sign of deflation as core inflation was steady at 2.0% y/y (May: 2.1%; Apr: 2.0%). This came from a steady contribution from services inflation, which added 0.95pp to the headline inflation (May: 0.92; Apr: 0.93).

Barclays notes:

- We expect inflation to start rebounding in H2 to an average of 1.3% on account of stabilised oil prices and potentially higher food prices on the back of warmer and drier weather conditions.

- The recent MERS outbreak may pose some downside pressure to the core measure in July as retailers offer discounts to attract shoppers, but we expect any distortion to be transitory and contained.

- We maintain our full year inflation forecast at 0.9% for 2015.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022