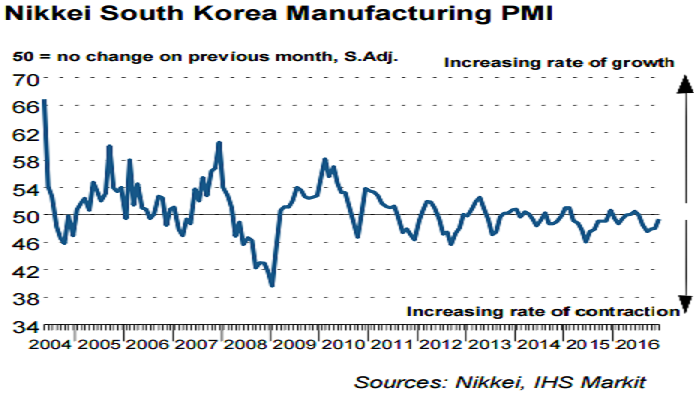

The growth of manufacturing activity in South Korea rose during the month of December, although remaining slightly away from the 50-point neutral mark, as production declined at the slowest pace in current five-month sequence of contraction. Also, new orders fell at softer pace, helped by a resumption of new export growth.

The headline Nikkei South Korea Manufacturing Purchasing Managers’ Index (PMI) posted 49.4 in December, up from 48.0 in November, signalling a weaker deterioration in operating conditions at South Korean manufacturers. Moreover, the latest reading was the highest since July. That said, the latest figure did not prevent the quarterly average from signalling the worst quarter since Q3 2015.

However, on a less positive note, employment declined at the quickest rate in over two years. On the price front, cost burdens rose to the greatest extent since May 2011, leading to an increase in charges for the first time in over three years.

Further, new export orders rose at the sharpest rate in nearly two years during December. Firms mentioned greater trade volumes with India, Thailand, China and Europe. Other panellists also commented on improved advertising and new product launches.

Meanwhile, manufacturers increased their buying activity at the sharpest rate since February 2015. In contrast, goods producers continued to cut back on staffing numbers for the fourth month running.

"The end of 2016 showed signs that the South Korean manufacturing sector had come through the worst of its downturn. Moreover, international demand rose at the sharpest rate in nearly two years, helped partly by the weakness of the South Korean won against the US dollar," said Amy Brownbill, Economist, IHS, Markit.

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances