The seasonally adjusted unemployment rate rose unexpectedly to 3.9% in May (consensus: 3.7%), after ticking lower in March from a February high (Apr and Mar: 3.7%; Feb: 3.9%; Jan: 3.4%). This partly reflects the sluggish patch in the export manufacturing sector and its faltering role as an engine of job creation.

Less ominously, however, it reflects an unexpected jump in the number of job seekers in May, which precipitated a rise in the labour participation rate (nsa) - from 62.8 in April to 63.3. On a seasonally adjusted basis, employment actually rose in May at a healthy rate, adding 46k jobs and reversing the two preceding months of declines (Apr: -41k, Mar: -105k).

Nonfarm private sector jobs climbed a healthy 52k, extending a 6k increase in April (Mar: -165k). This reflects resurgent private services employment, just as manufacturing job creation lost power. This is perhaps a sign that the government's three-year plan for economic innovation aimed at rejuvenating the hiring potential in key services industries is not bearing fruit fast enough.

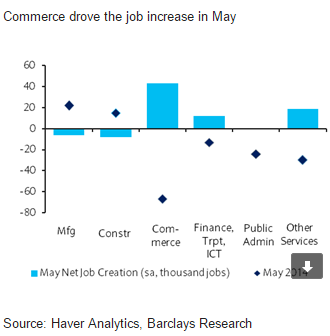

The two consecutive months of job shedding in both commerce and other services has ended. Both registered healthy increases in May - commerce +43k (Apr: -48k; Mar: -33k) and other services +19k (April: -10k; Mar: -57k). Finance added 12k jobs in May, as property transactions and demand for mortgages remained brisk.

Barclays notes:

- Looking ahead, we continue to expect new launches over the summer from the auto sector and mobile devices to revive the pace of factory hiring in the coming months. Elsewhere, public administration remained flat in May, while agriculture shed jobs (-5k; April: -47k; Mar: +36k).

- We think the labour market report reflects the sluggish soft patch in export-led manufacturing, amid a weak resurgence in domestic demand (services).

- With rates at an all-time low, we think more aggressive fiscal expansion (a larger supplementary package) and a weaker exchange rate bias are likely to play a larger role in the government's efforts to boost growth.

- We maintain our call for the BoK to remain on hold for the rest of the year. That said, the shock to consumer confidence in the wake of the recent MERS outbreak, coupled with sluggish exports, adds to the risk of further monetary easing - possibly in July, in our view - once the impact of the outbreak has been properly assessed.

- Additionally, the extended period of soft activity indicators including IP and exports underscores the need for a weaker KRW bias. Given the KRW REER is still holding above its 20-year average, we think the government may be hesitant to allow further appreciation in the near term.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX