UK employment report has helped pound push higher against all of its counterpart as inflation remains the last hurdle before a rate hike from bank of England. Higher wage growth is likely to ensure that demand comes back in UK economy, which would provide an upward thrust to inflation.

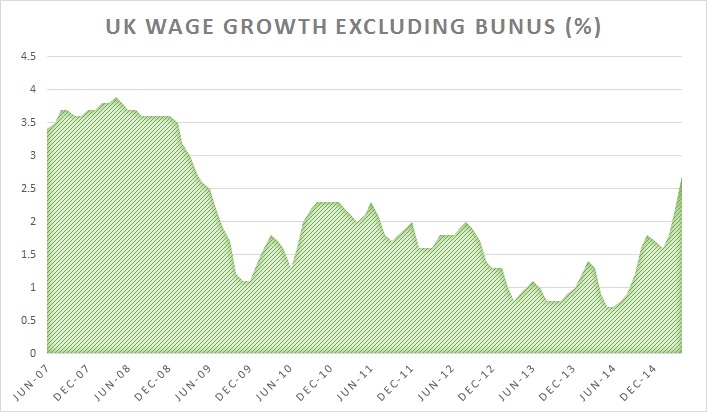

- Earnings report can be called as solid. Jobless rates remained at 5.5% for 3 months to April, however claimants count dropped further in May by 6500. Shining star of the report is wage growth. Average earnings rose by 2.7% both excluding and including bonus. This stands as highest level of growth registered in at least six years.

With such block buster report, there are few that can stand against pound.

Pound remains buy against its major counterparts such as Euro, Yen and New Zealand dollar.

However pound bulls face crucial test against Dollar today as FOMC is scheduled to announce monetary policy at 18:00 GMT.

Pound is likely to maintain the trend however and trade around 1.6 against dollar. Hawkish FOMC would result in buying pound at dips.

Pound is currently trading at 1.572 against dollar, support lies at 1.546-1.548 and resistance at 1.582-1.585.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary