The slowdown in industrial production (IP) and retail sales in July is likely to be temporary; we expect a rebound in the upcoming months. IP growth slowed to 6.4 percent y/y in July, weighed upon by the mining and manufacturing sectors. It is believed that a part of the slowdown stemmed from adverse weather conditions, whose effects will likely falter in the upcoming months.

Headline growth of retail sales decreased to 10.4 percent y/y in July from prior 11 percent. However, online sales remained quite vibrant, rising 28.9 percent y/y in the month, and are likely to continue to offset the moderation in growth among traditional retailers.

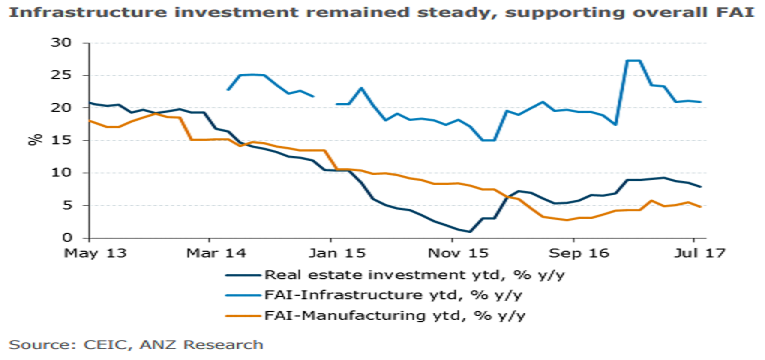

The growth of property investment eased to 7.9 percent y/y between January and July, the lowest this year. This seems to suggest that the government’s tightening policies have finally trickled down through the economy. However, land sales income for local provincial governments continued to surge 37.3 percent y/y in July.

"We continue to think the correction in the property market will be only moderate, even though the growth in property investment slowed further in July," ANZ Research commented in its latest report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility