Data released by the Ministry of Trade and Industry (MTI) showed Thursday that Singapore's headline inflation has accelerated slightly in February, in line with expectations. Singapore's headline inflation increased 0.7 percent y/y in February, compared to 0.6 percent y/y rise in the preceding month.

Headline CPI in Singapore had been dragged down over the past two years by lower global oil prices and have risen for the first time in two years in December 2016. February's rise was the third successive monthly rise and was mainly driven by a stronger pickup in private road transport costs.

Details of the report showed private road transport costs increased by 7.1 percent y/y, faster than the 4.1 percent rise in the previous month, largely due to unfavourable base effects in the preceding year. The Monetary Authority of Singapore’s (MAS) favoured core inflation came in at 1.2 percent in February, down from 1.5 percent in the previous month, owing to lower services and food inflation.

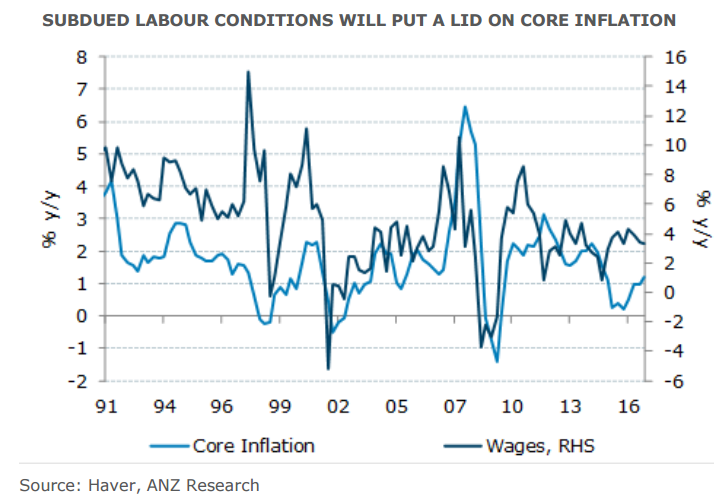

"Looking ahead, we do not foresee a broad-based increase in prices. Inflation is likely to moderately rise reflecting a combination of unfavourable base effects and upward adjustments in administered prices. Core inflation pressures are, however, likely to be muted given the labour market and weak wage growth by implication," said ANZ in a report to clients.

For the whole of 2017, MAS Core Inflation is expected to average 1-2 percent, compared with 0.9 percent in 2016. CPI-All Items inflation is projected to pick up to 0.5-1.5 percent this year, from -0.5 percent in 2016. Given that growth and inflation are panning out in line with its expectations, the Monetary Authority of Singapore is largely expected to maintain a neutral bias.

USD/SGD was currently trading around 1.40 levels at 1045 GMT. The pair is trading around 3.65 percent lower from 2017 highs of 1.4546. Near-term bias remains lower, but we see some consolidation around current levels before the pair resumes downside. Strong support for the pair is seen in the 1.3860-80 range. We see drag till 1.3860 levels. Further weakness can be seen only on break below.

FxWirePro's Hourly USD Spot Index was neutral at 33.3669 at 1045 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances