The Singaporean new benchmark 5-year bond yields are likely to fall in the near term, following higher overseas demand from asset managers in the upcoming bond auction, scheduled to be hosted by the Monetary Authority of Singapore (MAS) on Sep 28, Wednesday.

The MAS will auction SGD2.2 billion worth of SGS 5-year new bonds and is expected to take up SGD200 million of the issue, ANZ reported.

SGS bond yields were up some 20 basis points earlier this month, in tandem with a rise in the United States Treasury yields on concerns over the outlook for global banks’ accommodative monetary policies. However, the Bank of Japan’s commitment to monetary base expansion and the US Fed’s decision to stay pat on rates were a relief to the market. Since then, the SGS market has been trading better.

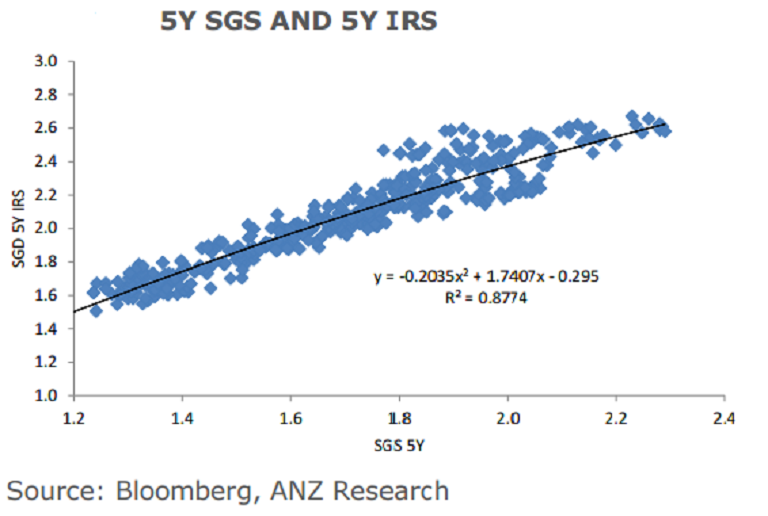

The 5-year tenor is slightly on the rich side in valuation, in asset-swap terms and along the curve. The 5-year generic bond yield is as much as 38bps lower than the 5-year swap, whereas recent historical relationship suggests a tighter spread of around 30bps. Compared to the 2-year and 10-year generic bond yields, the 5-year is on the low side compared to recent spreads.

"We expect a positive reception to this auction, which is for a new 5Y benchmark bond and the last scheduled auction for the year. We expect demand from index asset managers, both onshore and offshore," ANZ commented in its report.

Meanwhile, at closing, the yield on the new benchmark 5-year bonds, which moves inversely to its price, fell 1-1/2 basis points to 1.246, while the Strait Times Index (STI) traded 0.38 percent higher at 2856.95.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022