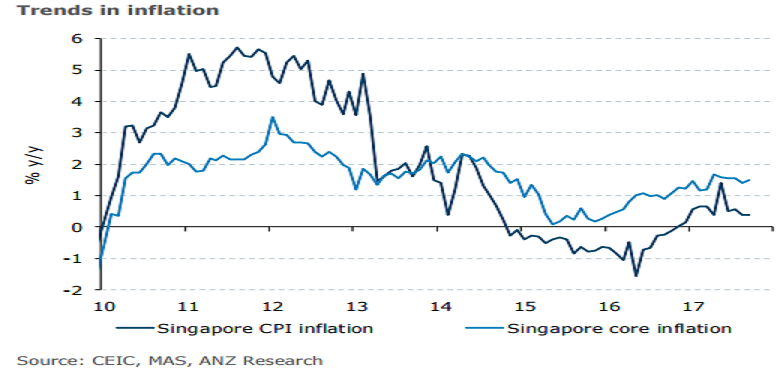

Singapore’s headline inflation stabilized at 0.4 percent in September, in line with market estimates. Core inflation edged up slightly due to an increase in services costs and telecommunications fees in particular.

As such, any near-term price pressures are not seen. Monetary policy should, therefore, remain in neutral mode. However, we will be examining the Q3 labor market data due this Friday to assess whether there has been any improvement in the employment and wage situation. Labour market conditions tend to be a good leading indicator of inflation in Singapore.

On an m/m basis, headline inflation was flat in September compared with a 0.3 percent increase in the preceding month. Private road transport costs contracted 0.3 percent m/m, reflecting both lower car prices as well as a moderation in COE premiums. Accommodation costs fell 0.3 percent m/m amid lingering softness in the home rental market.

By contrast, food prices edged up 0.2 percent m/m. Meanwhile, core inflation, which in Singapore’s case, excludes accommodation and private road transport costs, edged up slightly. However, apart from telecommunication service fees, other components remained subdued in their recent ranges.

"Consequently, inflationary pressures have been muted. The inflation data reinforces our view that there is no urgency for the Monetary Authority of Singapore (MAS) to exit from their current neutral policy stance," ANZ Research commented in its latest report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations