Singapore headline consumer inflation turned positive in December on higher private transport costs, snapping a very long trend of declining prices which began in November 2014. Also, we foresee that the consumer inflation is expected to move further up in the coming months following the developments in private transport prices.

“We forecast core inflation to increase only modestly to 1.3 percent into 2017 from 0.9 percent in 2016, at the lower half of the Monetary Authority of Singapore’s (MAS) expectation of 1-2 percent,” reported ANZ in its research note.

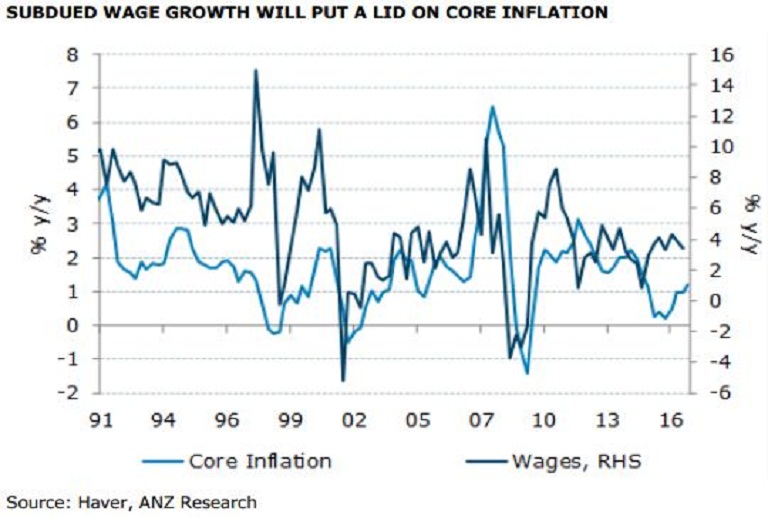

The ANZ in its research note mentioned that a return to positive headline CPI inflation disguises underlying softness, given the absence of more generalised demand-induced pressures. Domestic cost pressures will be muted, owing to a subdued labour market which will put a lid on wage growth. Furthermore, a moderation in commercial rentals will exert a strong disinflationary drag. With activity set to stay subdued, core inflation pressures will be held firmly in check

Further, they added that the private road transport costs will likely inch up at the end of 2016 and into 2017, largely as a result of the upward revisions of car park charges with effect from 1 December 2016 and increased petrol prices. However, core inflation is unlikely to pick up meaningfully amid a weak growth environment and the subdued property market.

Meanwhile, USD/SGD traded 0.60 percent lower at 1.4180 by 06:40 GMT.

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm