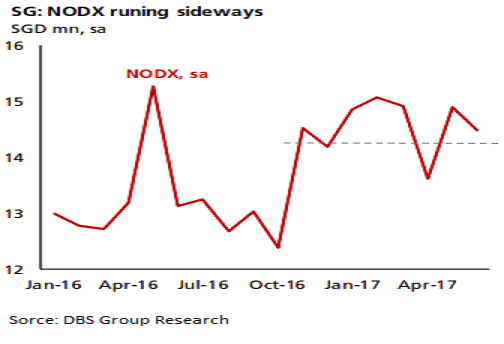

Singapore’s export performance will likely hold up. Non-oil domestic export (NODX) sales for July due tomorrow will likely register an expansion of 9.1 percent y/y. While this is up from 8.2 percent in the previous month, it’s nothing more than just a sideway moves in the data series.

Net off some base effect and possible uptick from exports of pharmaceutical products and the headline NODX growth will probably be where it was previously. The rally in electronics export is losing steam. Though a contraction is not expected in the near term, the PMIs, semiconductor billings, and shipments data are hinting of some side-way moves in the electronics exports.

Separately, the pharmaceutical industry had a rough patch over the past three months and is due for a rebound. An uptick in this export segment will be enough to push the headline figure slightly higher compared to the previous month, DBS Bank reported.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk