US has not only taken out Saudi Arabia as world's largest producer, the balance of power in oil market has tilted away from OPEC to North America.

Shale boom in US, has resulted in massive hydrocarbon fuel production, natural Gas and crude oil. In spite of 50% drop in oil price, US production of crude has actually gone up, currently at 9.4 million barrels/day.

This has so far, led to price war between oil producers across world, as US has slowed its import of oil from Middle East and African continent.

- Latest API report suggests inventory continue to increase at rapid pace. According to American petroleum Institute (API), inventory increased by 12.2 million barrels compared to 3 million expected. EIA reported inventory rise by 10.95 million barrels.

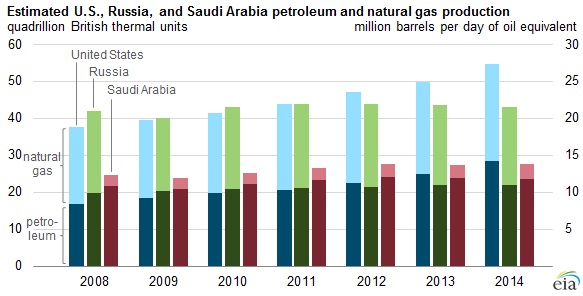

- According to report from EIA, since 2008, U.S. petroleum production has increased by more than 11 quadrillion British thermal units (Btu) whereas combined hydrocarbon output in Russia increased by 3 quadrillion Btu and in Saudi Arabia by 4 quadrillion.

- In spite of lower energy prices, U.S. petroleum production still increased by 3 quadrillion Btu (1.6 million barrels per day) in 2014. Natural gas production increased by 5 quadrillion Btu (13.9 billion cubic feet per day) over the past five years.

Best is yet to come -

- So far US production has been barred from export. Possibilities are high that at some point US will gradually allow exports, probably when new government comes to power over next election. This will create havoc not only for oil price but geo-political balance.

- Even if US keeps the export ban in place, the country might still become self-hydro carbon sufficient. That means another 7 million barrels/day, which US still imports will be in search of buyers.

WTI is currently trading at $51.73/barrel, despite recent bounce back downtrend still remains in play.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?