S&P500 recovered sharply and jumped more than 50 points from yesterday's low of 2911.US Fed has kept its interest rate unchanged at 2.25-2.50% as expected. The central bank has removed "patience" from its policy statement and mentioned that it would "act as appropriate to sustain the expansion". The index hits a fresh all-time high at 2959 and is currently trading around 2958.

US 10 year yield hits 1.976% lowest level since Sep 2016 and spread between 10 year and 3 month has narrowed to 16 basis point from 25 basis point.

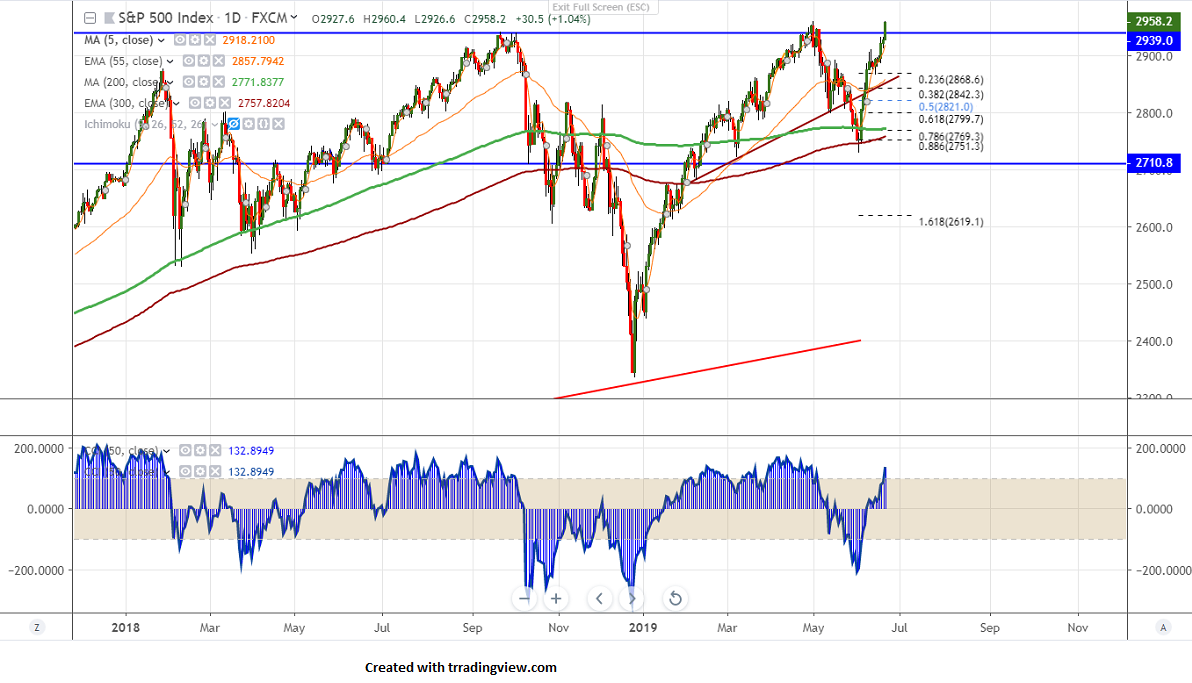

Technically, the index has broken 2959.30 high made on May 1st 2019 and this confirms that decline from 2959.30 has stopped at 2728. The new bullish trend has started and a jump till 3000 is possible.

On the flip side, near term support is around 2905 and any violation below that level targets 2885/2866 low made on Jun 13th 2019. Minor weakness only below that level.

It is good to buy on dips around 2900-10 with SL around 2866 for the TP of 3000