S&P500 - "Hey Oil, wait for me"

As oil continues to slide past decade low and attempting to drop past $30 /barrel psychological support, S&P 500 has started to follow oil's direction, just like two good friends, too good perhaps.

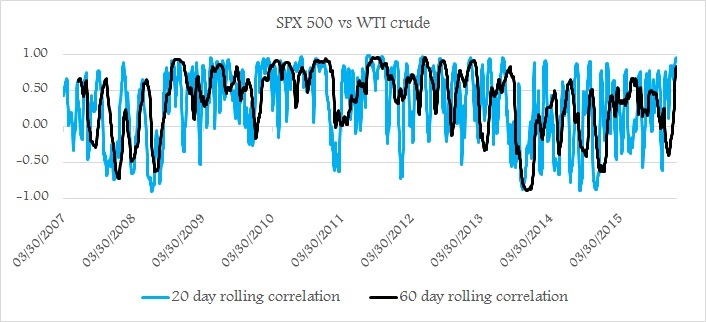

As the figure shows, 20 day rolling correlation has been reaching to new heights not seen for years. Last time S&P 500 was this related to oil price was back during 2013. 20 day rolling correlation between S&P 500 and WTI crude just reached 97%, just shy of last eight years record of 99%. 60 day rolling correlation stands at 84%, meaning in last sixty trading days, in 805 of cases S&P 500 and oil has moved in the same direction.

What making us cautious is these high levels of friendship may not exist for long and those traders betting shorting S&P 500, looking at oil might have to pay dearly. Just yesterday, we heard some traders saying if oil recovers, so will stocks. It might but it is also vital to consider might not.

History have shown these friendships break up abruptly and sometimes stay in negative territory following such extent.

Moreover, looking at recent stocks and commodity selloffs, we at FxWirePro, believe break up in these two's friendship could very well be a turning point.

But for today, WTI is down close to 4% and S&P 500 following suit with close to 1% decline.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022