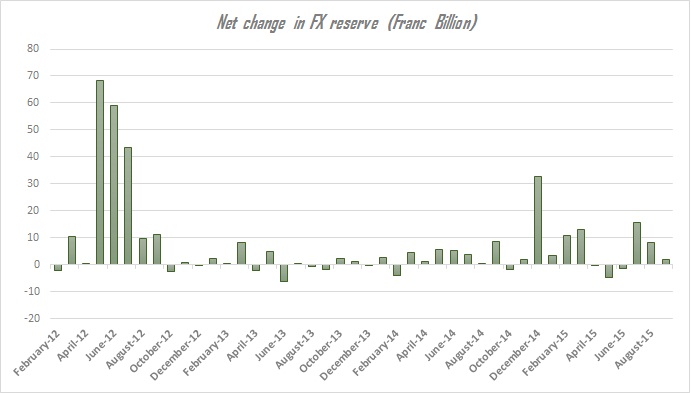

Latest reserve data from Swiss National Bank (SNB) suggests SNB might have reduced pace of its intervention in September after heavy firing in July.

In July, SNB reported net change in FX reserve by $15.2 billion, which was highest since December last year, just a month before SNB withdrew its 1.20 floor in Euro/Franc.

Back in July, Euro was hovering against France at around 1.03 level, from where by next two month Euro was back trading above 1.10 against Franc. SNB was slowly reducing the pace of intervention from July. In August FX reserve rose by around $9 billion and in September just by $2 billion.

SNB has the largest balance sheet compared to GDP, which is now close to 90% of GDP. So the bank is not likely to continue its massive intervention in the EUR/CHF market but instead push the pair to the direction and let the market do the rest.

Net change in FX reserve is shown in the figure.

It can be inferred from the intervention pattern that SNB in the short term comfortable with the pair trading around 1.10, while utterly discomfort able around 1.03 area.

Euro is currently trading at 1.088 against Dollar.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate