After January's sudden move to remove 1.20 floor, it is difficult to rely on SNB to protect any Euro-Franc level.

However SNB intervened in the market today, as Euro was expected to tumble, which would have invariably pushed Euro-Franc towards parity.

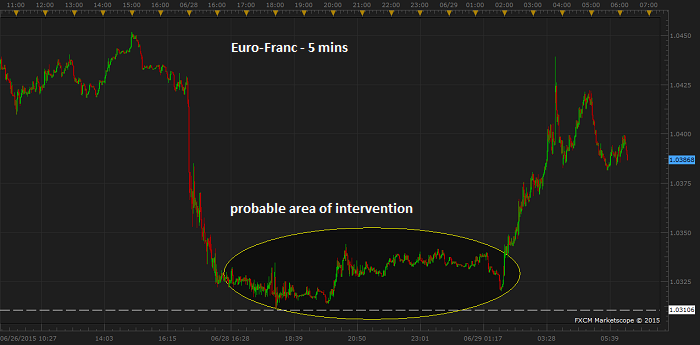

Talks suggest that SNB has intervened around 1.03 area, though details of the intervention wasn't declared by the bank. SNB intervention pushed Euro from around 1.03 area, after which it traded as high as 1.044 against Franc. Currently Euro is trading at 1.039 against Franc and 1.11 against dollar.

After months of sitting tight on Euro-Franc level, today's intervention seems SNB is likely to Keep Euro above parity.

Further intervention from SNB is expected as Greek uncertainty persists in the market.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary